An overseas remittance is a transfer of money, often to an individual or another party in the sender’s home country.

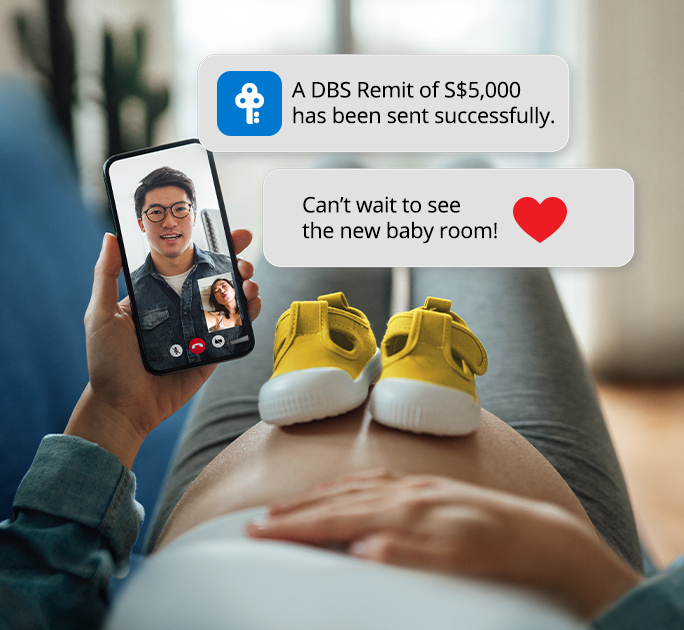

From sending money overseas to a family member, to sending it on behalf of your foreign domestic worker, or perhaps as parents disbursing monthly allowance to your overseas-studying children, the reasons are endless.

If you are someone who regularly remits money, you may want to learn about using DBS Remit for your monetary transactions beyond Singapore’s borders.

Here are 4 reasons why.

Convenient Transfers Anywhere

Ever had to queue up for hours at the remittance agency? Or perhaps wished for a more convenient way of transferring funds abroad?

With DBS Remit, you can transfer funds abroad anytime and anywhere. Even better, you can transfer directly to the overseas account without the hassle of going through extra administration effort.

All you need is your POSB/DBS digibank plus internet connectivity and you are good to go!

Seamless Transaction Process

So you’re connected to the internet and are ready to send some money overseas. That’s great! But won't things be even better if you could spend less time tapping on your phone or laptop as you try to navigate through the transaction process?

Sometimes the process can involve many steps, like instructing an overseas transfer, topping up a holding account, awaiting confirmation of your top-up–all before the funds get transferred.

DBS Remit, however, removes all those extra steps. There’s no need to top up funds into a separate holding account. Instead, you can make an overseas transfer in one seamless process on Digibank/iWealth, where we directly transfer the funds via your preferred bank account.

Secured Transactions

Making a bank transfer shouldn’t just be convenient, it must also be secure. The most common concern for a lot of people is the fear that your money might not reach the intended party after it is sent. This anxiety gets magnified when an overseas party is involved. That’s why it’s important to transact with a reputable bank you can trust and be rest assured the funds will reach the other side safely.

Save More

One of the major considerations when sending funds abroad is the cost. When you engage the services of remittance companies to make overseas transfers, you may incur a slew of processing fees each time. Wouldn’t it be great if those fund transfers were free?

Well, they are! With DBS Remit, you can send your money to more than 50 destinations, from Australia to USA, at zero-dollar transfer fees. For those who transfer money abroad regularly, saving on these remittance fees can add up to huge savings.

Same-day transfers at $0 fees apply when you transfer money online to the following countries: Australia, Bangladesh, Canada, Eurozone countries, Hong Kong, India, Indonesia, Japan, South Korea, Malaysia, Mainland China, Myanmar, New Zealand, Philippines, Thailand, UAE, UK, USA and Vietnam.

Try DBS Remit today using this step-by-step guide to send money across borders

So the next time you’re sending money overseas, consider using DBS Remit - it’s Convenient, Seamless, Secure and helps you Save!

S$12 cashback welcome gift

New to DBS Remit? Receive S$12 cashback when you remit at least S$300 within the same calendar month with NEWREMIT promo code. Promotion ends 31 Dec 2024. Find out more.

Keen to find out more about how you can use DBS Remit to make fuss-free, safe and quick transfer online? Read up on all the facts you need to know about DBS Remit here.

Don’t forget to also check out this step-by-step guide on how to use DBS Remit to send money overseas using your digibank mobile app or iWealth.