ILP: How it serves your needs

![]()

If you’ve only got a minute:

- ILPs offer twin benefits of life insurance protection and investment.

- They can be categorised into single-premium ILPs and regular-premium ILPs.

- Perks of ILPs include premium holidays, free fund switches and a curated list of diverse funds to choose from.

- Managing ILPs is a long-term commitment, and the returns are not guaranteed.

![]()

An investment-linked insurance policy (ILP) offers the twin benefits of life insurance protection and investment. That’s like having the best of both worlds with a single policy.

You can use cash, and even CPF savings via the CPF Investment Scheme (CPFIS) to buy an ILP if the ILP is included in the scheme.

But do you know how it works and how best to manage your ILP?

Types of ILPs

ILPs can be categorised into:

- Single-premium ILPs – You pay a lump sum premium to buy units in a fund. Most single-premium ILPs provide lower insurance protection than regular premium ILPs.

- Regular premium ILPs – You pay premiums on an ongoing basis (eg. monthly). Regular premium ILPs allow you to invest consistently and may allow you to vary the level of insurance coverage you need.

How do ILPs work

Your premiums paid are first used to purchase investment units in professionally managed investment-linked fund(s).

Depending on the structure of the ILP, the amount used to purchase fund units could be 100% of your regular premiums or only part of it.

The cost of insurance (COI) and other charges (e.g. administrative charges) are then subsequently deducted by selling investment units that have been accumulated.

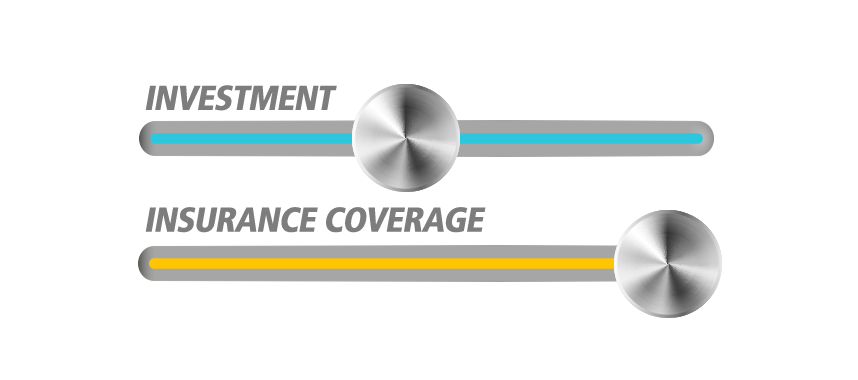

There will be a trade-off between the amount of insurance coverage provided and the amount available for investment. For example, if an ILP has high coverage, more units will be used to pay for the insurance charges and fewer units will remain to accumulate cash values under your policy.

Protection coverage

Even though there is insurance coverage in an ILP, purchasing an ILP does not usually require underwriting and no medical check-up is required.

You may enhance your protection coverage by adding optional riders. Optional riders may require medical underwriting and can cover you for a range of benefits (e.g. total and permanent disability)

Some ILPs provide a waiver of premiums benefit as well such that in the event of TPD or critical illness, your future premiums will be waived.

Investment

ILPs allow you to choose and invest from a range of investment funds available with the insurer. The funds usually cater to different investment objectives, risk profiles and time horizons. The performance of the fund can be tracked through the daily publication of unit prices.

Manulife ILPs offered via DBS allow you to select from a specially curated list of ILP funds that are regularly reviewed based on the rigorous research by the Manulife Global Manager Research team and DBS Fund Select Team.

You are allowed to switch your investment from one fund to another - this is known as fund-switching - free of charge. Doing so allows you to change your investment strategy.

Perks and Risks of ILPs

What are some of the benefits and important points to note for ILPs?

| Perks | Risks |

|---|---|

| Higher potential returns | Returns are not guaranteed |

| Flexibility to adjust coverage and investments | May have to reduce insurance coverage |

| Premium holidays | |

| Free fund switches and rebalancing |

Perks of ILPs

1. Higher potential returns

While you bear the full investment risk and the returns are not guaranteed, there is potential to get higher returns than other life insurance policies such as traditional whole life and endowment plans, if the funds perform well. This is because ILPs buy unit trusts (“ILP funds”) which deal directly with the market.

2. Flexibility to adjust coverage and investments

With ILPs, your investment units will pay for your insurance coverage. So, increasing your coverage (subject to underwriting) involves selling investment units to get more insurance coverage.

Most ILPs allow you to top up and withdraw your investments as and when you want to (may be subjected to charges). You can adjust the balance between the investment and insurance (protection) elements in your plan to achieve your preferred outcome.

Some ILPs offer more flexibilities than others. For example, Manulife InvestReady (III) and Manulife SmartRetire (V) offer an option to receive your dividends as payouts and allow withdrawal of dividends without charges.

3. Premium holidays

Usually, insurance policies get terminated if your payments lapse. But with ILPs, you can temporarily stop premium payments. This can be useful if you are in between jobs or if you need to put your money towards other needs such as an emergency. During this premium “holiday”, the ILP will not be terminated as the existing units can be sold to continue paying for insurance coverage.

4. Free fund switches and rebalancing

An advantage of investing through an ILP is the offer of free fund switches within the list of funds. Other investments may involve redemption fees (when you sell) and subscription fees/initial sales charges (when you buy) when you switch funds.

Fund switches are useful if market conditions change or if your chosen funds are not performing as well as others. This allows you to change your investment strategy according to your financial circumstances, risk appetite or investment outlook.

But before you do that, check with the ILP distributor how many free switches you are allowed and how much fees you would have to pay for switching if you have used the maximum number of fund switches. Some ILPs provide you with the option to automatically rebalance your portfolio as well.

Manulife ILPs offered via DBS offer unlimited fund switching free of charge.

Important points to note of ILPs

1. Returns are not guaranteed

Unlike participating whole-life plans which use most of your premiums for insurance coverage and some parts for investments, ILPs purchase funds that are invested in the market. The returns of ILPs are not guaranteed.

The amount that you could stand to receive from your policy is dependent on the value of your units when you sell them, after fees and charges.

2. May have to reduce insurance coverage or cash value

As you age, the insurance charges of the policy increase as the risk of death, disability and illnesses increases.

To provide for the same level of insurance coverage, investment units may be sold to pay for the cost of insurance and administrative charges. If the investment fund does not perform well, the value of your units may not be enough to pay for the insurance charges hence you may have to reduce your insurance coverage (if your ILP allows) or top-up premiums.

When there is insufficient account value to deduct the applicable fees and charges, the policy will lapse and you will lose the insurance coverage.

How to manage investments in your ILP

1. Commit long-term

Managing ILPs can be compared to a fitness plan where you commit to a long-term routine to maintain a healthy lifestyle. To best benefit from the compounding effects, an ILP should be held for the long-term to benefit from market cycles and not as a trading instrument where you buy and sell your funds frequently.

2. Assess risk appetite & investment objectives

Before starting a fitness plan, you need to assess your current health and fitness level and set achievable goals. Similarly, before choosing an ILP, you need to understand your risk appetite and investment objectives to choose the right funds that suit your financial goals

3. Dollar-cost average

A fitness plan requires you to put in consistent effort to see results, and the same goes for ILPs. Through a regular premium ILP, you can invest via dollar cost averaging (DCA) - a practice of regularly investing a fixed dollar amount in a specific investment - regardless of fluctuations in market price. This provides an easier way to navigate volatile markets and helps alleviate the potential negative effects of “active trading” on investment returns.

4. Diversify

Spread your risk and avoid placing all your eggs into one basket. Select a variety of sub-funds to invest in with your ILP to diversify across asset classes, countries, and industries. This could provide you with a better chance of a successful investment experience.

5. Perform regular reviews

As you are investing in the markets, regularly review your financial situation and risk profile. Do rebalance the funds in your ILP as needed. Some ILPs offer you the option to automatically rebalance your portfolio for free.

If you prefer an accumulation solution to “buy-and-forget”, you can also consider endowment insurance policies. Just like how staying healthy requires consistent effort, exercise, and a proper diet, ILPs require a long-term commitment to regular premium payments, portfolio reviews, and occasional top-ups to reach your financial goals.

Are ILPs suitable for you?

Before you sign up for an ILP, consider these:

- Can you take the risk of not having guaranteed returns?

- Does an ILP fit your investment objective and risk profile?

- What is the time horizon of your investment?

- Do you understand the fees and charges of the ILP?

If your main purpose for getting an ILP is to accumulate wealth, consider having a realistic amount of protection in your policy. As opposed to an ILP with a death benefit of 105% of total premiums paid, an ILP offering much higher protection coverage (e.g. 150% of total premiums paid) will mean less capital is available for your investment. An ILP may not be suitable for you if your financial need is primarily on pure protection.

ILPs offered via DBS are focused on wealth accumulation that allocate 100% of the regular premiums into the purchase of fund units.

Whether you are looking to preserve, grow, or transfer wealth, ILPs can be part of the solution in your financial plan that complements other investment and insurance products.

Ready to start?

Speak to the Wealth Planning Manager today for a financial health check and how you can better plan your finances.

Alternatively, check out NAV Planner to analyse your real-time financial health. The best part is, it’s fuss-free – we automatically work out your money flows and provide money tips.

Disclaimers and Important Notice

This article is meant for information only and should not be relied upon as financial advice. Before making any decision to buy, sell or hold any investment or insurance product, you should seek advice from a financial adviser regarding its suitability.

All investments come with risks and you can lose money on your investment. Invest only if you understand and can monitor your investment. Diversify your investments and avoid investing a large portion of your money in a single product issuer.

Disclaimer for Investment and Life Insurance Products

That's great to hear. Anything you'd like to add?

We're sorry to hear that. How can we do better?