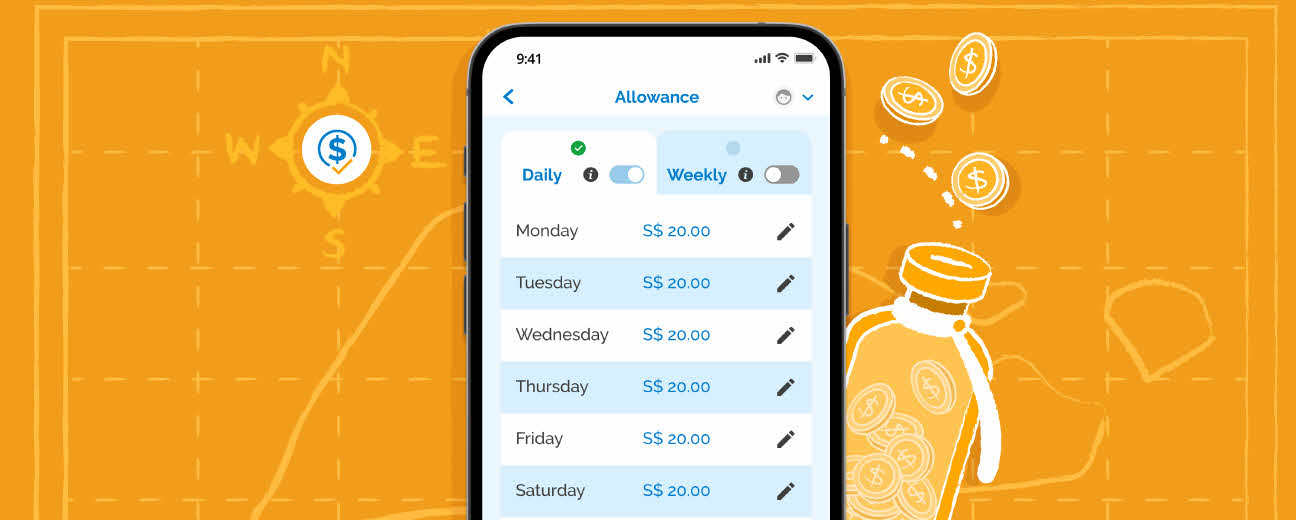

1. Set allowances for your child and discuss about budgeting

2. Get an overview of their spending in and out of school in real time

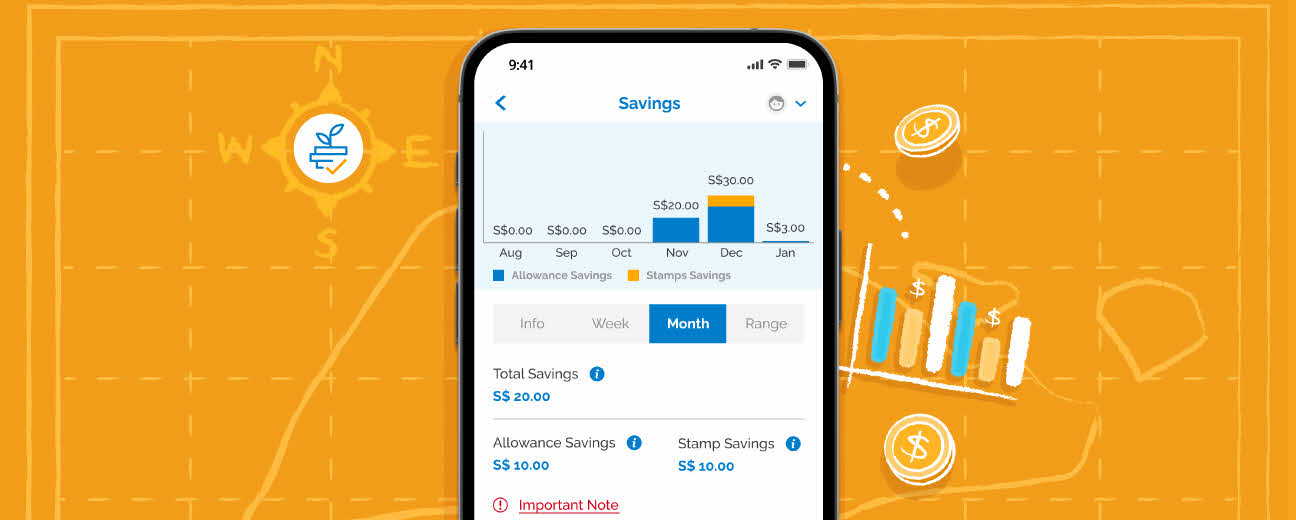

3. Track their savings progress and teach them the value of money

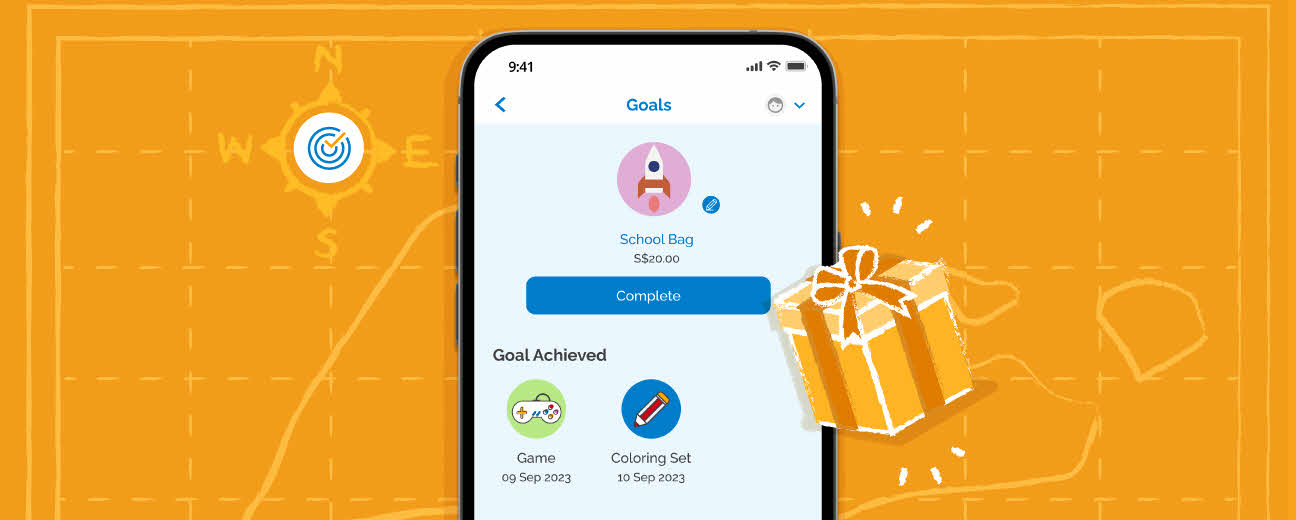

4. Set savings goals with your child and reward them for their achievements

5. Encourage your child to collect Smiley Stamps and save more

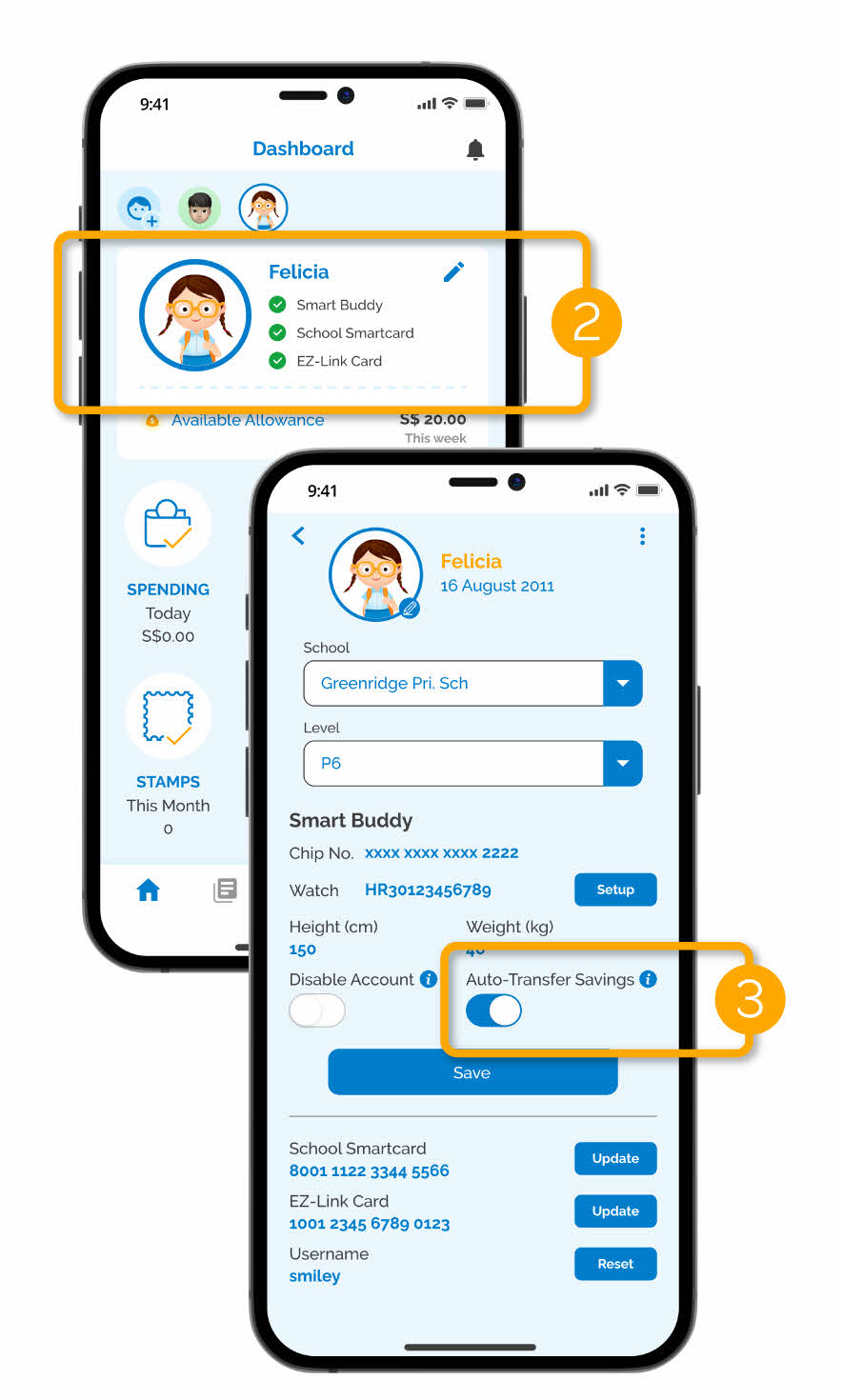

| Step 1Don't have a POSB/DBS account for your child yet? Find out more. Step 2Tap on your child's profile in the Smart Buddy mobile app Download the full Smart Buddy app user guide Step 3Enable "Auto-Transfer Savings" option. Your child's total Smart Buddy savings will now be auto-transferred to their linked account every month1 |

1 Transfer of savings to the child's linked bank account will be completed by the 10th of the following month

- The total Stamp Savings Value savings will be credited to the parent's linked bank account if there is no active child's account linked with Smart Buddy. Find out how to link your child's account here.

S$1 Bonus Dollar reward is only eligible to Smart Buddy users who have

- At least 1 completed Smiley Savings Card (i.e. 20 Smiley Stamps)

- An active child's account linked

- S$1 Bonus Dollar will only be rewarded up to once every month

- The total Stamp Savings Value (including S$1 Bonus Dollar) will be credited to the linked child's account (if any), regardless of the "Auto-Transfer Savings" status.

Find out more about Smart Buddy and apply here.

Frequently Asked Questions

You can also link them to our Smart Buddy mobile app and track their in-school spending as their school Smartcard and EZ-Link card are compatible with our app.

However, applying for Smart Buddy watch/card will allow your child to enjoy the full suite of benefits while learning good money habits.

| Features available on Smart Buddy mobile app | Smart Buddy Card / Watch | School Smartcard / EZ-Link | |

|---|---|---|---|

| Disable card when lost* | |||

| Auto-transfer child's Smart Buddy savings to their account | |||

| Set child's allowance with spending limit | |||

| Child's allowance debited from | Parent's linked bank account | Stored value in card (top-up required) | |

| View transactions in-app (available in both parent and child access) | All transactions (in and out-of-school)* | Only transactions in school | |

*Only transactions made on Smart Buddy terminals in school and NETS retailers outside of school would be tracked and reflected in the app. The use of Smart Buddy for transport fares (i.e MRT/Bus) is not recommended as these non-NETS related transactions are not tracked and cannot be disabled via the app.

Yes, children may opt to pay using their Smart Buddy or cash at the canteen or bookshop.

No. The Smart Buddy card/watch is not recommended for MRT and bus rides. All transit usage will be priced at full adult fare and users may experience intermittent performance. Allowance and Disable Account features on the Smart Buddy app does not apply to public transport fares.

If used, please note that the transit transactions will not be reflected in the Smart Buddy app. The transit fare charges will be accumulated for up to 5 days or after a total of $15 is spent on transit fares, whichever is earlier. The accumulated amount will then be posted to the parent debiting account as 'MRT/BUS' transactions after 3 days and postings will be reflected based on the processing time of the bank.

For further information or checks on trip details, kindly visit TransitLink website.

You may temporarily disable the Smart Buddy watch by switching the "Disable Account" to "On" under your child's profile. In the event the watch is found, you may enable it again by switching the "Disable Account" to "Off".

Do note that disabling the account only disables its usage on Smart Buddy terminals and NETS retailers outside of school. Non-NETS related transaction (i.e MRT/Bus ride) will not be disabled.

Refer to the “More Information” section at the bottom of the “Lost or Damaged Smart Buddy Card/Watch” help and support page.

The watch is warranted for one year against manufacturing defects on the watch body and the watch electronic function itself. Signs of abuse and misuse will void the warranty. Straps are not covered in this warranty. Terms & Conditions apply.

If your watch is still under warranty, to replace your faulty watch, you will need to raise a replacement request through your Smart Buddy mobile app.

To find out if your watch is still under warranty or steps on how to raise a watch replacement request, refer to the ‘Smart Buddy Watch Warranty/Replacement’ section in the mobile app guide here.

If your watch is no longer under warranty, you may purchase a new Smart Buddy watch via eShoppenow.

No, it is not a wallet. The Smart Buddy app only provides transactional info (e.g. allowance balance, spending and saving trends etc.) and useful tips on personal finance and money matters for both parent and child.

To automatically transfer your child's unspent allowance and stamp savings into his/ her own DBS/ POSB bank account, parents will need to first link your child's account with Smart Buddy and then turn on the 'Auto-transfer Savings' feature under your child's profile on the Smart Buddy mobile app.

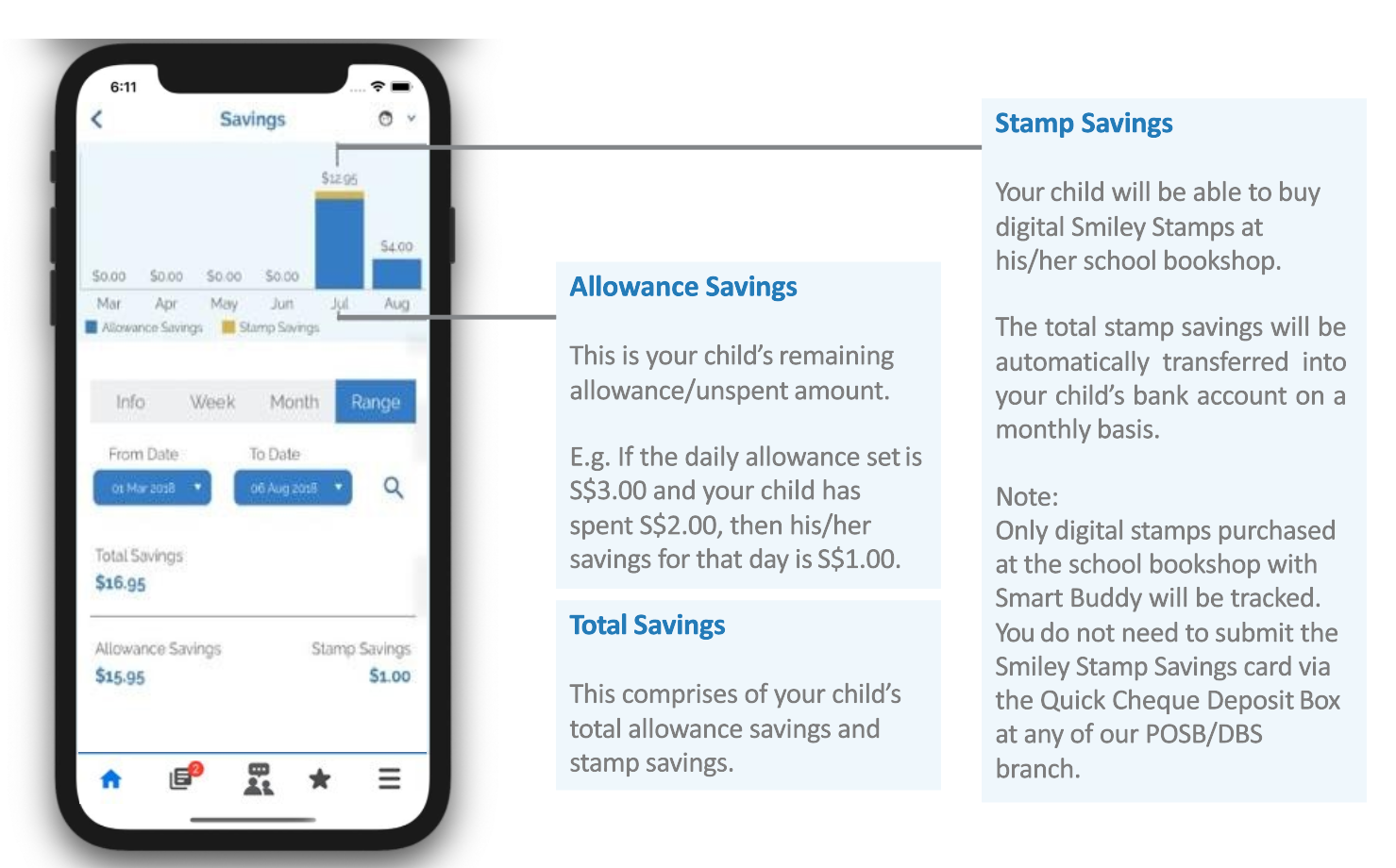

You can check your child’s total monthly savings from the “Savings” screen on the POSB Smart Buddy app.

Once done, your child's monthly savings [unspent allowance and stamp savings (if any)] will be transferred from your linked debiting account and into the linked child's account by the 10th of the following month. Parents are to ensure that there is sufficient balance in the parent's debiting account during the first 10 days for a successful crediting/ transfer.