Change Fixed Deposit Maturity Instructions

Learn how you can change Maturity Instructions for DBS Fixed Deposit Account via digibank online and digibank mobile.

Important information

- Change of maturity instructions will not be allowed on the day of maturity. The principal and interest will be renewed automatically based on the same tenor at the prevailing interest rate, unless you provide us with other instructions at least 1 working day before the maturity via digibank.

- SGD Fixed Deposit interest rates for new placements and renewals will be computed based on the Total SGD Fixed Deposit Balances, instead of each placement and/or renewal.

Examples

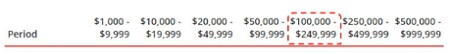

- My Fixed Deposit account has 2 placements which sum up to S$100,000 (S$30,000 + S$70,000). What is the applicable interest rate for each renewal?

The total Fixed Deposit account balance is S$100,000 (S$30,000 + S$70,000). Hence, interest rate corresponding to the $100,000 - $249,999 range will apply.

-

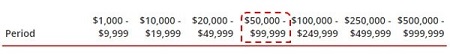

I have an existing placement of S$50,000 in my single name Fixed Deposit account and another S$50,000 in a joint Fixed Deposit account. What is the applicable interest rate for each renewal?

The placements are in different SGD Fixed Deposit accounts. Hence, interest rate corresponding to the $50,000 - $99,999 range will apply for each renewal.

- My Fixed Deposit account has 2 placements which sum up to S$100,000 (S$30,000 + S$70,000). What is the applicable interest rate for each renewal?

- Foreign Currency Fixed Deposit interest rates for new placements and renewals will be based on prevailing interest rates.

- For more information on Rates, click here.

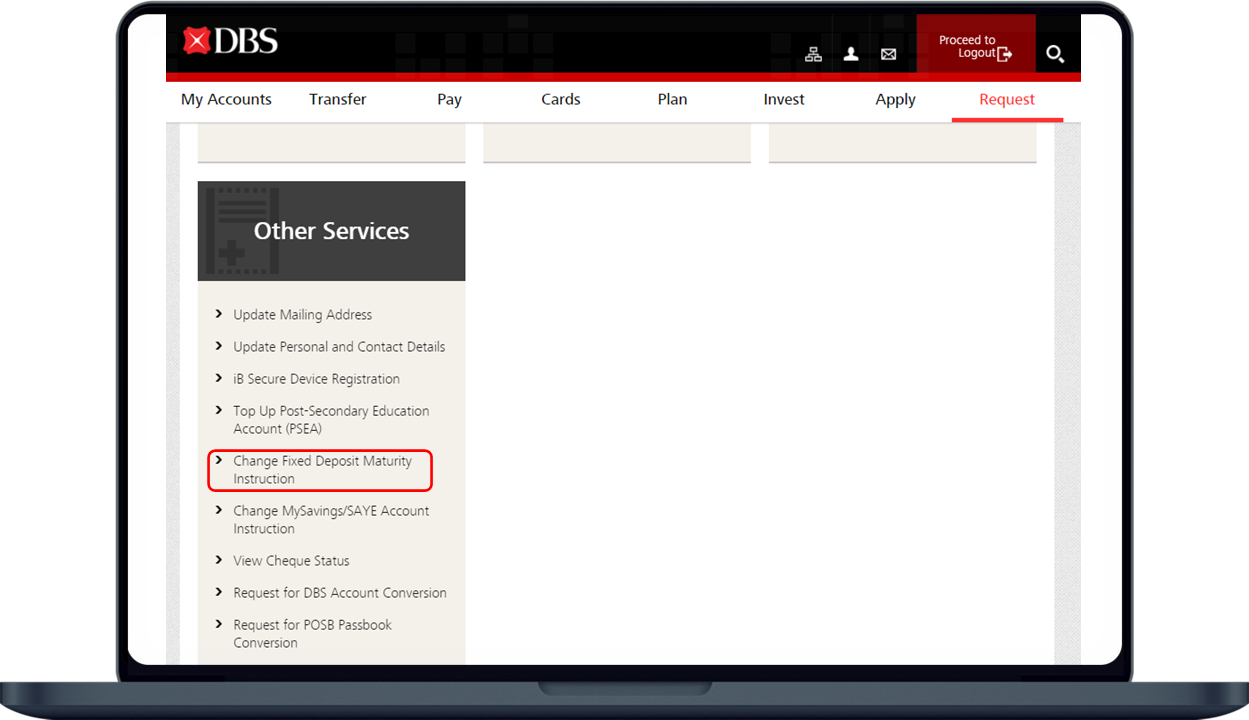

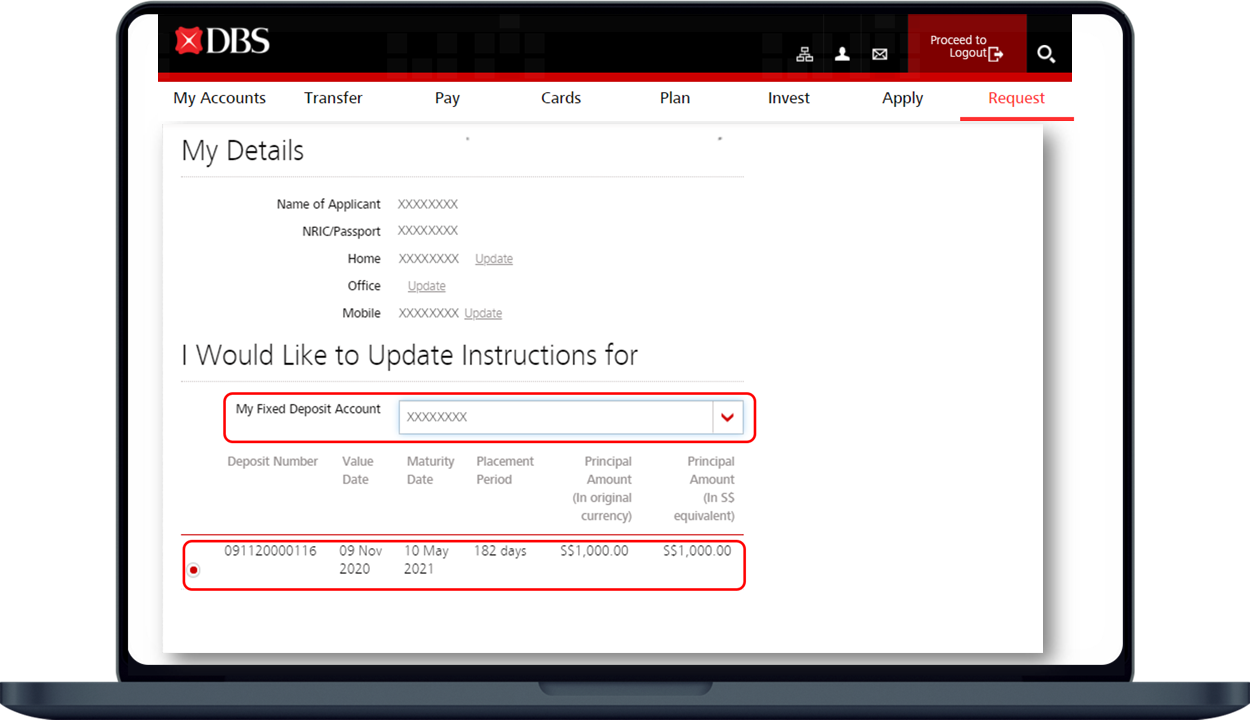

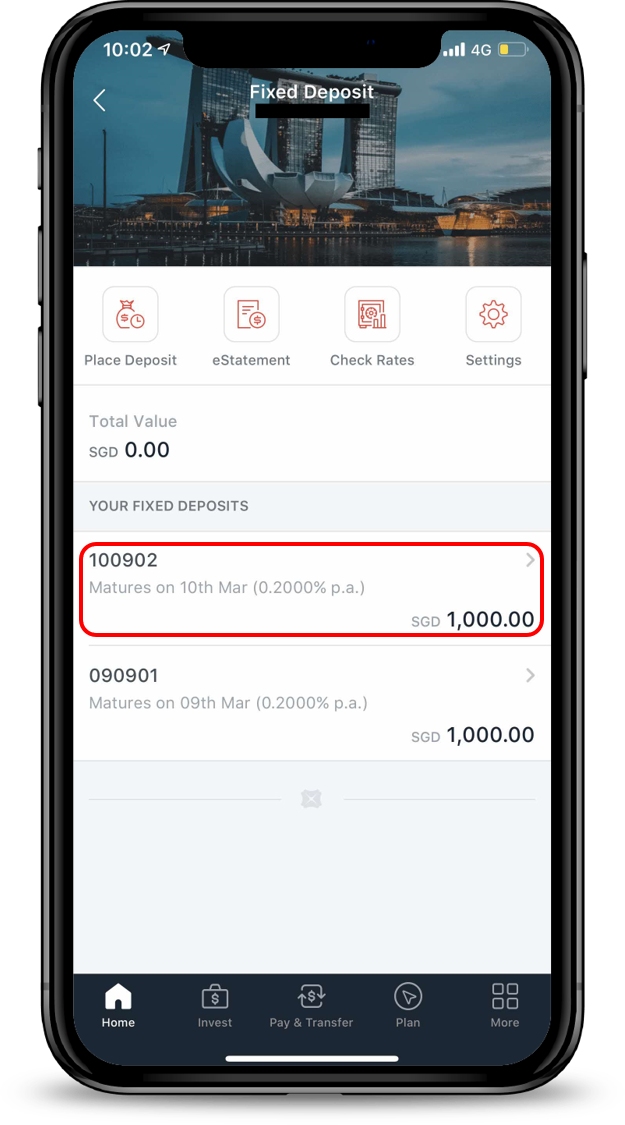

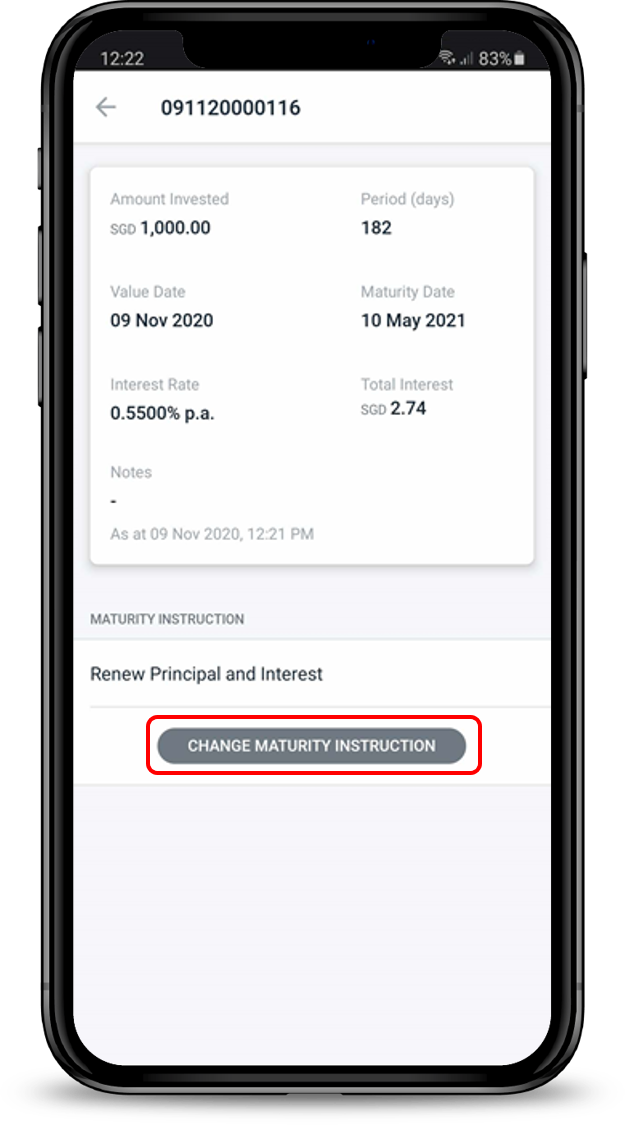

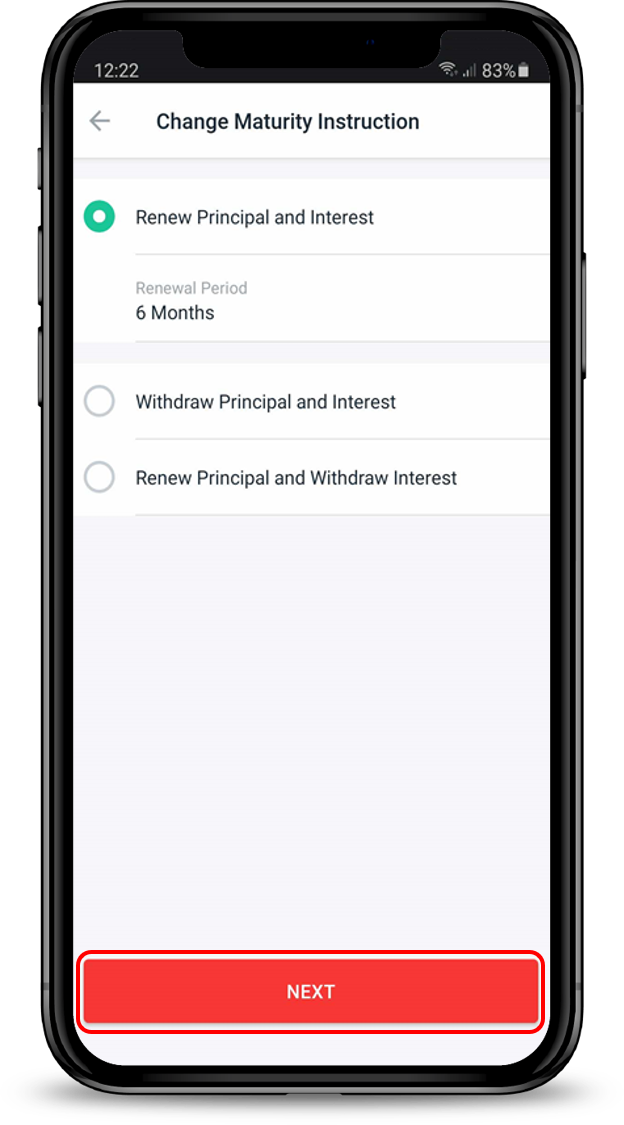

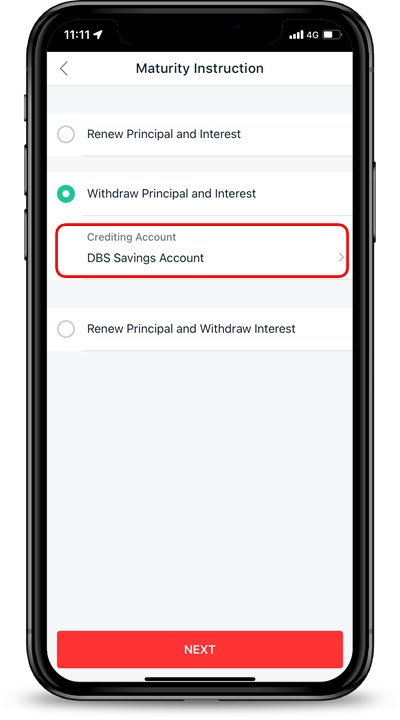

How to Change Fixed Deposit Maturity Instructions

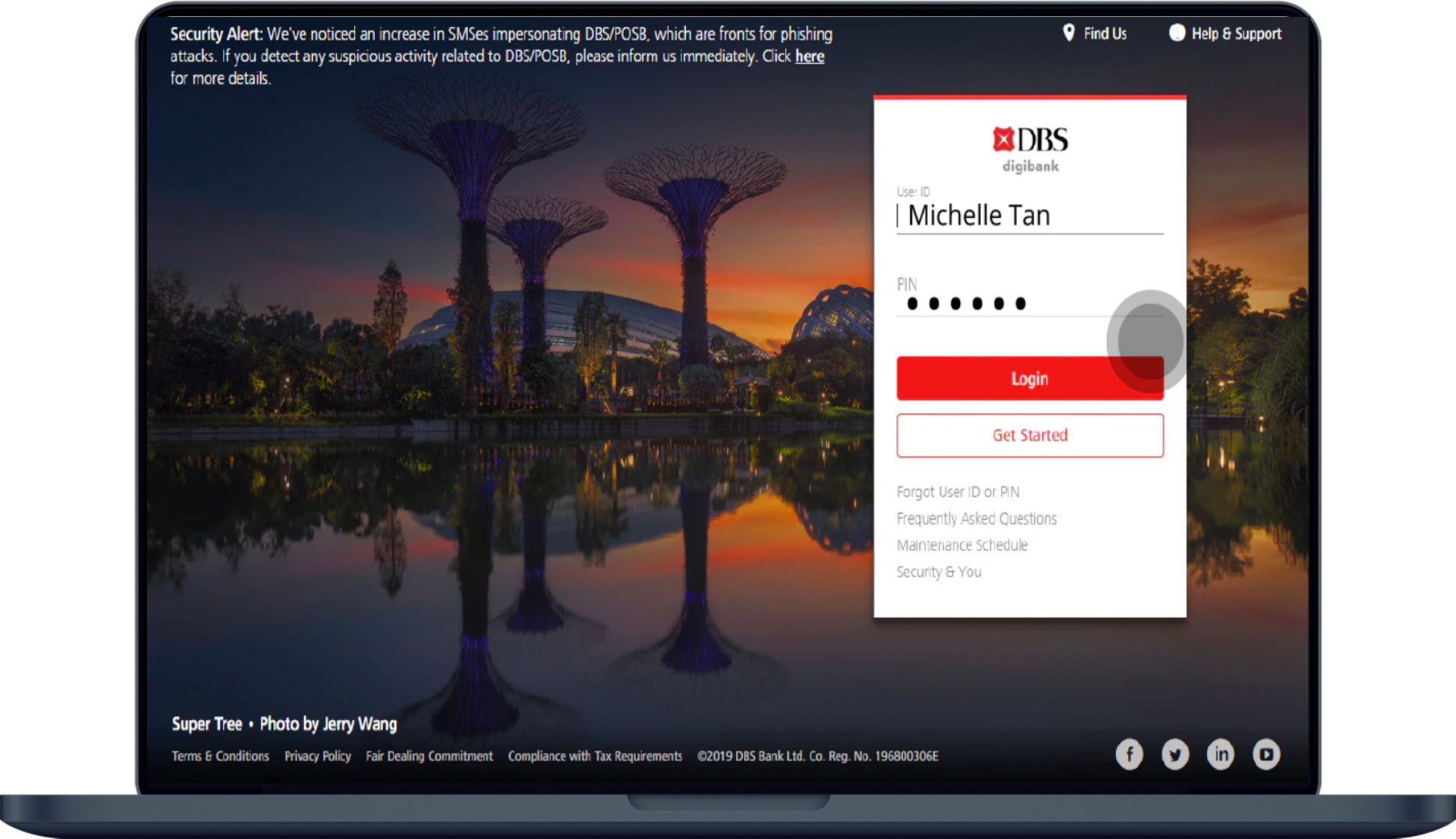

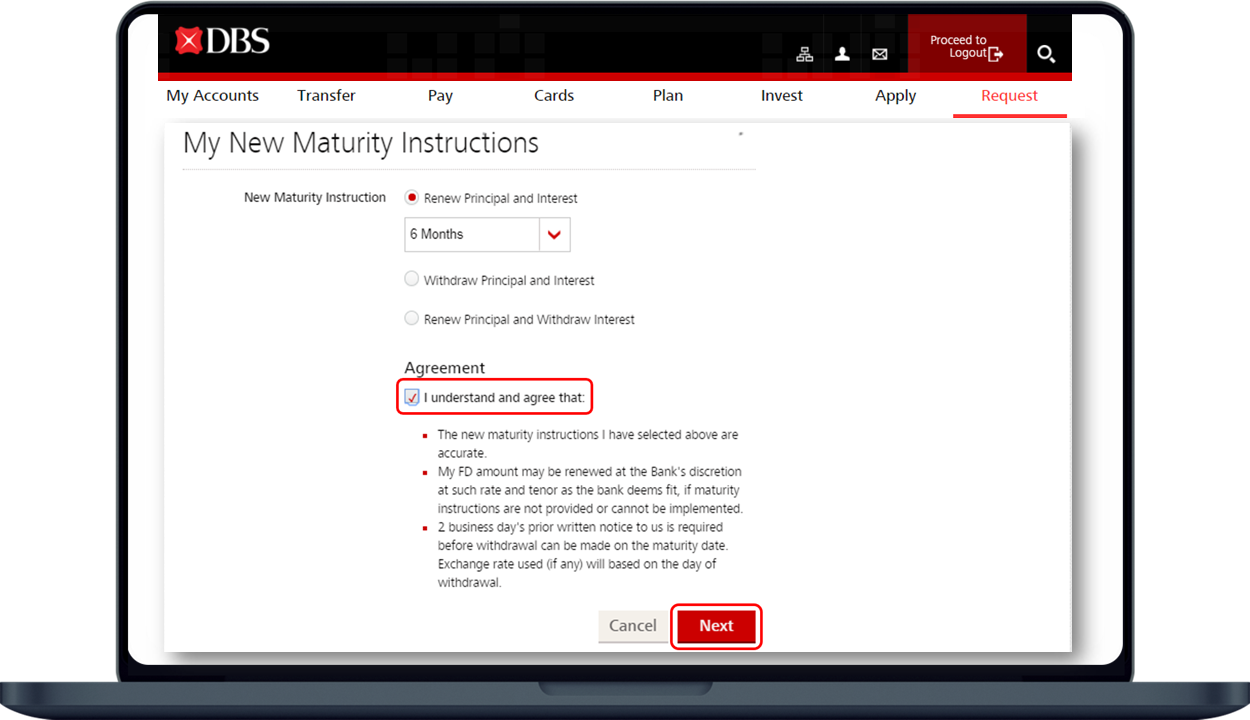

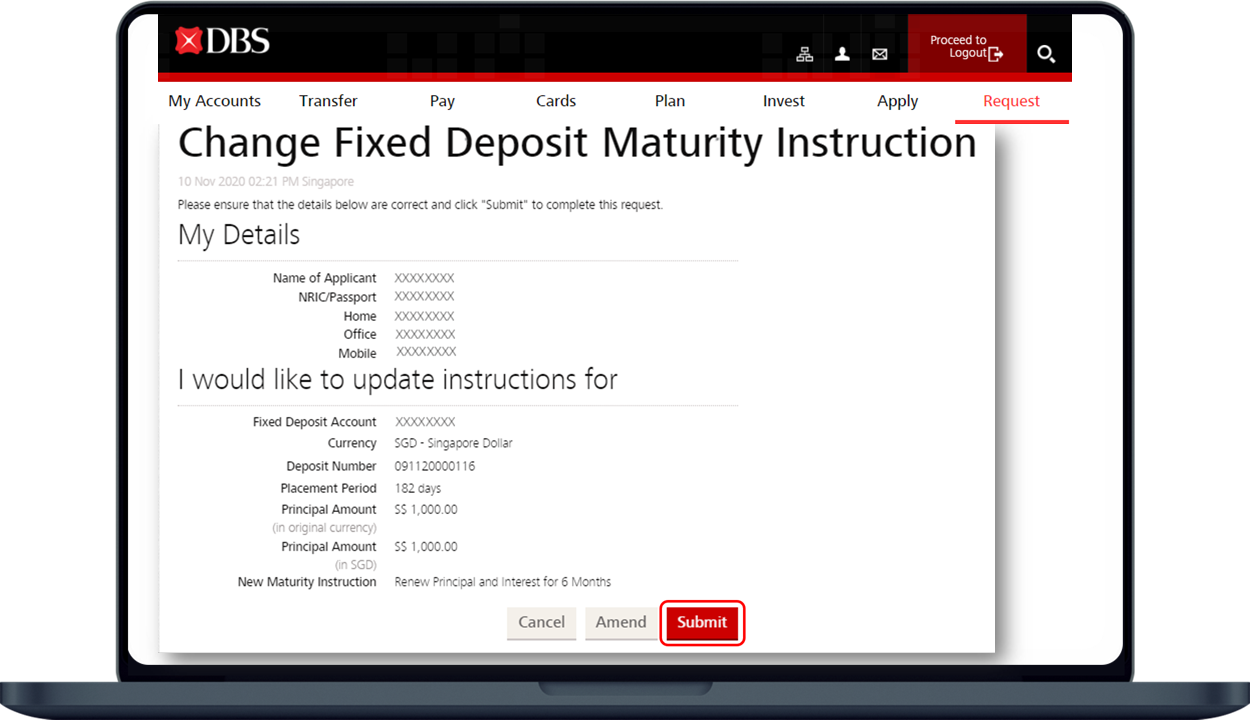

digibank online

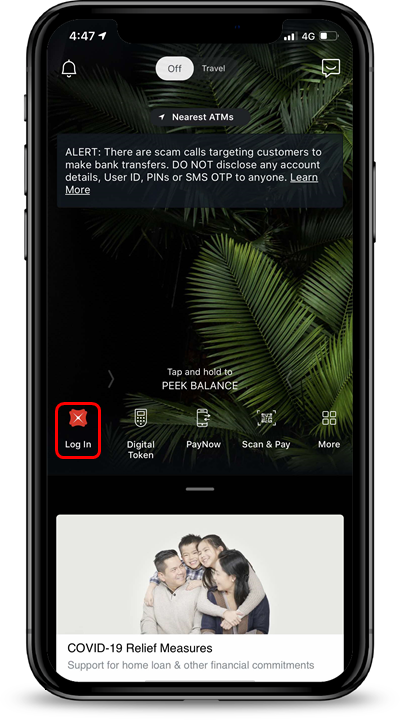

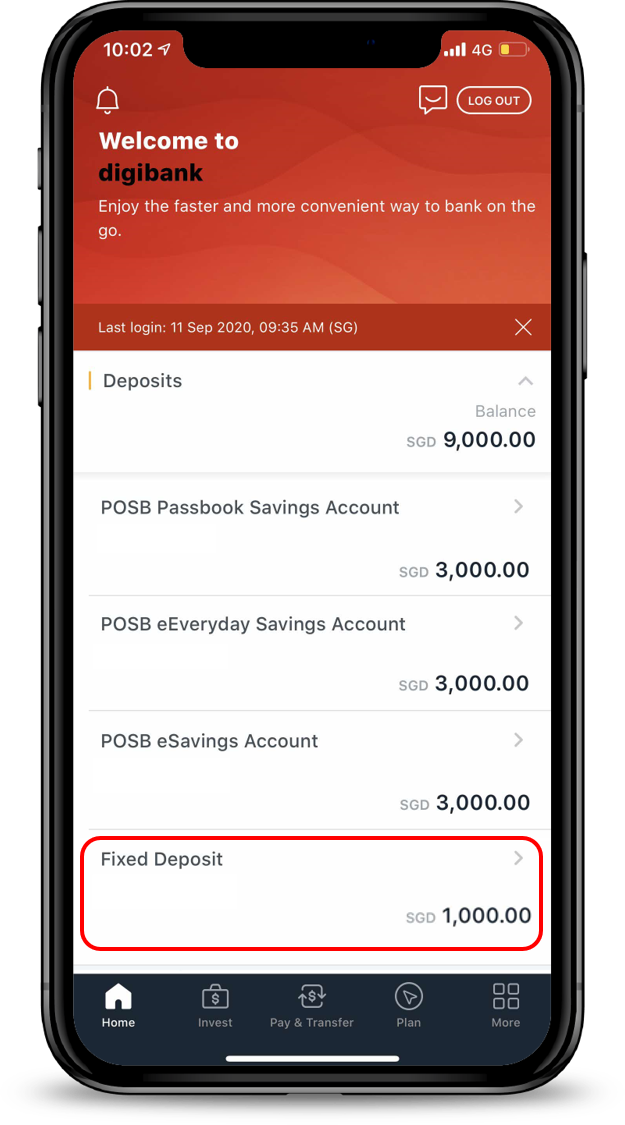

digibank mobile

More information

- For matured fixed deposits, the principal and interest will be credited into your designated account on the date of maturity.

If the designated account is closed before/on the date of maturity, the principal and interest will renew with the same tenor at the prevailing interest rate at day end of the maturity date.

Was this information useful?