Understanding Multiplier’s Interest and Eligible Transactions

Find out how the interest is calculated and the eligible transactions under each product category for Multiplier Account.

How is the interest calculated?

- The preferential interest rate is applied to the end-day SGD balance in your DBS Multiplier Account.

- Interest earned for each balance tier is calculated and rounded off to the nearest 4 decimal places.

- Each day’s interest earned is summed up and rounded off to the nearest 2 decimal places.

- The entire month's interest is then summed up.

- Calculate my Multiplier preferential interest.

What are the eligible transactions under each product category?

- Learn more about different categories for Multiplier Account.

Eligible Transactions

Transaction Name / Description

|

Eligible Period/ Criteria | Eligible Category

|

|---|---|---|

| ABC Company name |

|

Income (Mandatory) |

| PAY, ABC Company name, GIRO-SALARY |

|

Income (Mandatory) |

| Dividend Credit from Central Depository Pte Ltd (CDP) | Credited into any personal or joint DBS/POSB deposit accounts, DBS Wealth Management Account, Supplementary Retirement Scheme (SRS) account or CPF Investment Account (CPFIA) | Income (Mandatory) |

| Dividend Credit from DBS Vickers Securities – All Markets | Credited into any personal or joint DBS/POSB deposit accounts, DBS Wealth Management Account, Supplementary Retirement Scheme (SRS) account or CPF Investment Account (CPFIA) | Income (Mandatory) |

| Dividend Credit from DBS Online Equity Trading (OET) - All Markets | Credited into any personal or joint DBS/POSB deposit accounts, DBS Wealth Management Account, Supplementary Retirement Scheme (SRS) account or CPF Investment Account (CPFIA) | Income (Mandatory) |

| Dividend Credit from DBS Unit Trusts | Credited into any personal or joint DBS/POSB deposit accounts, DBS Wealth Management Account, Supplementary Retirement Scheme (SRS) account or CPF Investment Account (CPFIA) | Income (Mandatory) |

| Dividend Credit from DBS Online Funds Investing | Credited into any personal or joint DBS/POSB deposit accounts, DBS Wealth Management Account, Supplementary Retirement Scheme (SRS) account or CPF Investment Account (CPFIA) | Income (Mandatory) |

| Dividend Credit from DBS Invest-Saver | Credited into any personal or joint DBS/POSB deposit accounts, DBS Wealth Management Account, Supplementary Retirement Scheme (SRS) account or CPF Investment Account (CPFIA) | Income (Mandatory) |

| Retail spend (eg. Shopping or dining) |

|

Credit Card Spend |

| Cash Advance |

|

Credit Card Spend |

| SimplyGo |

|

Credit Card Spend |

| Top-up for Ezlink |

|

Credit Card Spend |

| Bill payment via internet banking |

|

Credit Card Spend |

| Bill payment via AXS app or machines |

|

Credit Card Spend |

| Recurring bill payment (eg. Town Council or SP services) |

|

Credit Card Spend |

| Monthly instalment for private properties using CPF and/or Cash |

|

Home Loan Financing |

| Monthly instalment for HDB flats using CPF and/or Cash |

|

Home Loan Financing |

| CancerCare |

|

Insurance |

| Critical SelectCare |

|

Insurance |

| eCriticalCare |

|

Insurance |

| eDecreasingTerm |

|

Insurance |

| LifeReady Plus (II) |

|

Insurance |

| Manulife SmartRetire (II) |

|

Insurance |

| Manulife SmartWealth (III) |

|

Insurance |

| Manulife Spring (II) |

|

Insurance |

| ManuProtect Decreasing (II) |

|

Insurance |

| ManuProtect Decreasing Lite (II) |

|

Insurance |

| ManuProtect Term (II) |

|

Insurance |

| ManuProtect Term Lite (II) |

|

Insurance |

| Ready LifeIncome (II) |

|

Insurance |

| ReadyBuilder (II) – Regular Premium |

|

Insurance |

| RetireReady Plus (III) – Regular Premium |

|

Insurance |

| SavvySpring (II) |

|

Insurance |

| DBS Invest-Saver |

|

Investments |

| Unit Trust lump-sum contribution via DBS/POSB |

|

Investments |

| Online equity trades via DBS |

|

Investments |

| Payments to merchants through DBS PayLah! in-app checkout |

|

PayLah! Retail Spend |

| Payments to merchants through merchant in-app checkout |

|

PayLah! Retail Spend |

| Payments to merchants through web checkout |

|

PayLah! Retail Spend |

| Payments to merchants through express checkout |

|

PayLah! Retail Spend |

| Scan & Pay transactions to pay merchants via NETS QR code |

|

PayLah! Retail Spend |

| Scan & Pay transactions to pay merchants via SGQR code |

|

PayLah! Retail Spend |

| Scan & Pay transactions to pay merchants via PayNow QR code |

|

PayLah! Retail Spend |

| Payments to billing organisations using DBS PayLah! App |

|

PayLah! Retail Spend |

| Donations to charitable organisations using DBS PayLah! (Android App only) |

|

PayLah! Retail Spend |

| digiPortfolio |

|

Investments |

| Bonds |

|

Investments |

| Structured Deposit |

|

Investments |

| Currency Linked Investments |

|

Investments |

| Structured Notes |

|

Investments |

| Heirloom (VII) |

|

Insurance |

| Manulife Goal 9 |

|

Insurance |

| ReadyBuilder (II) |

|

Insurance |

| RetireReady Plus (III) |

|

Insurance |

| RetireSavvy |

|

Insurance |

| SavvyEndowment 6 |

|

Insurance |

| Signature Income Series |

|

Insurance |

| Signature Indexed Universal Life (II) |

|

Insurance |

| Signature Indexed Universal Life Select |

|

Insurance |

| Signature Life Series |

|

Insurance |

| Signature Wealth |

|

Insurance |

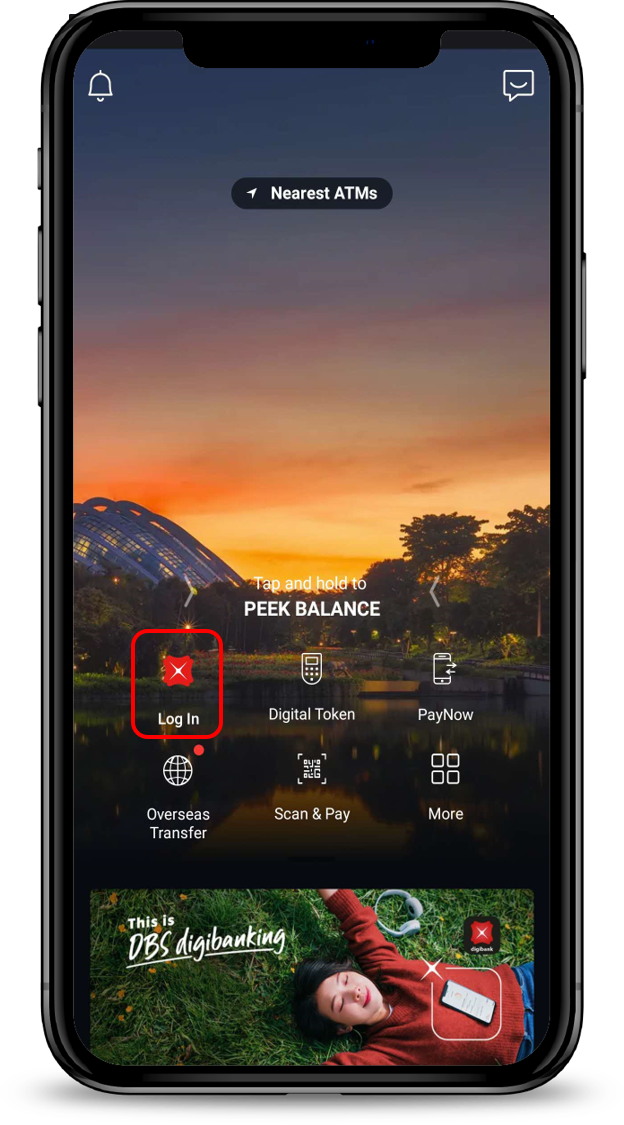

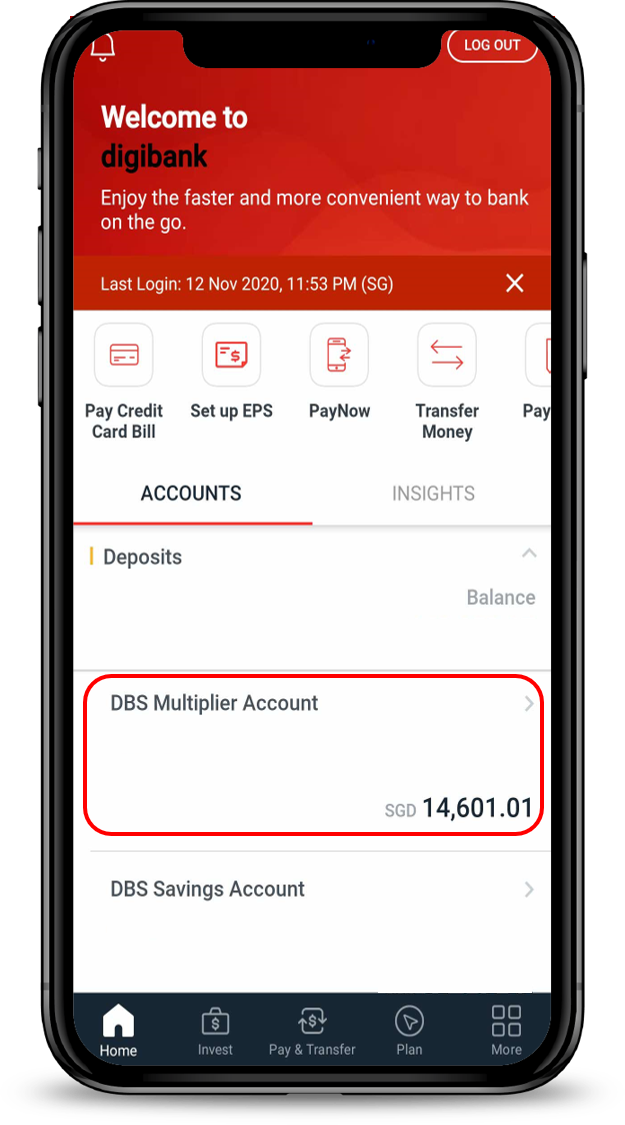

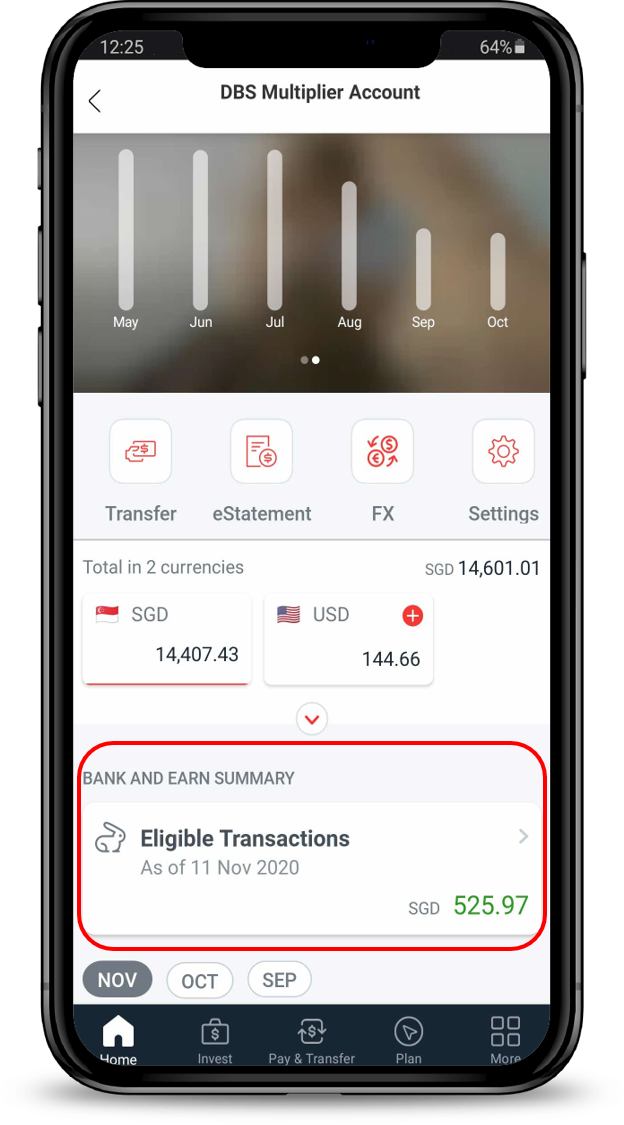

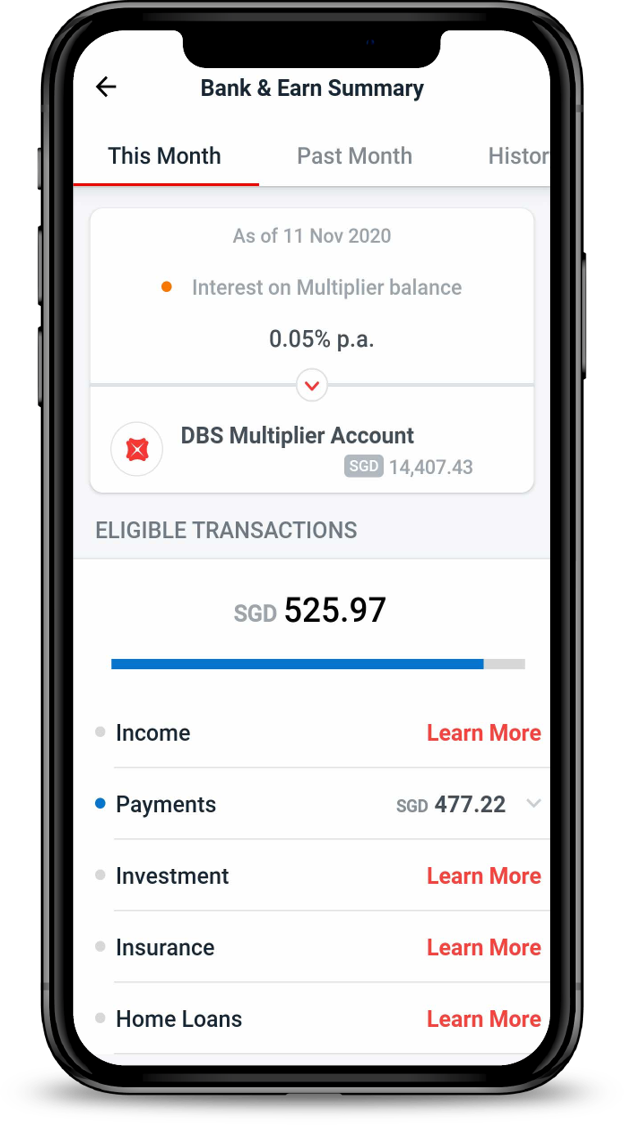

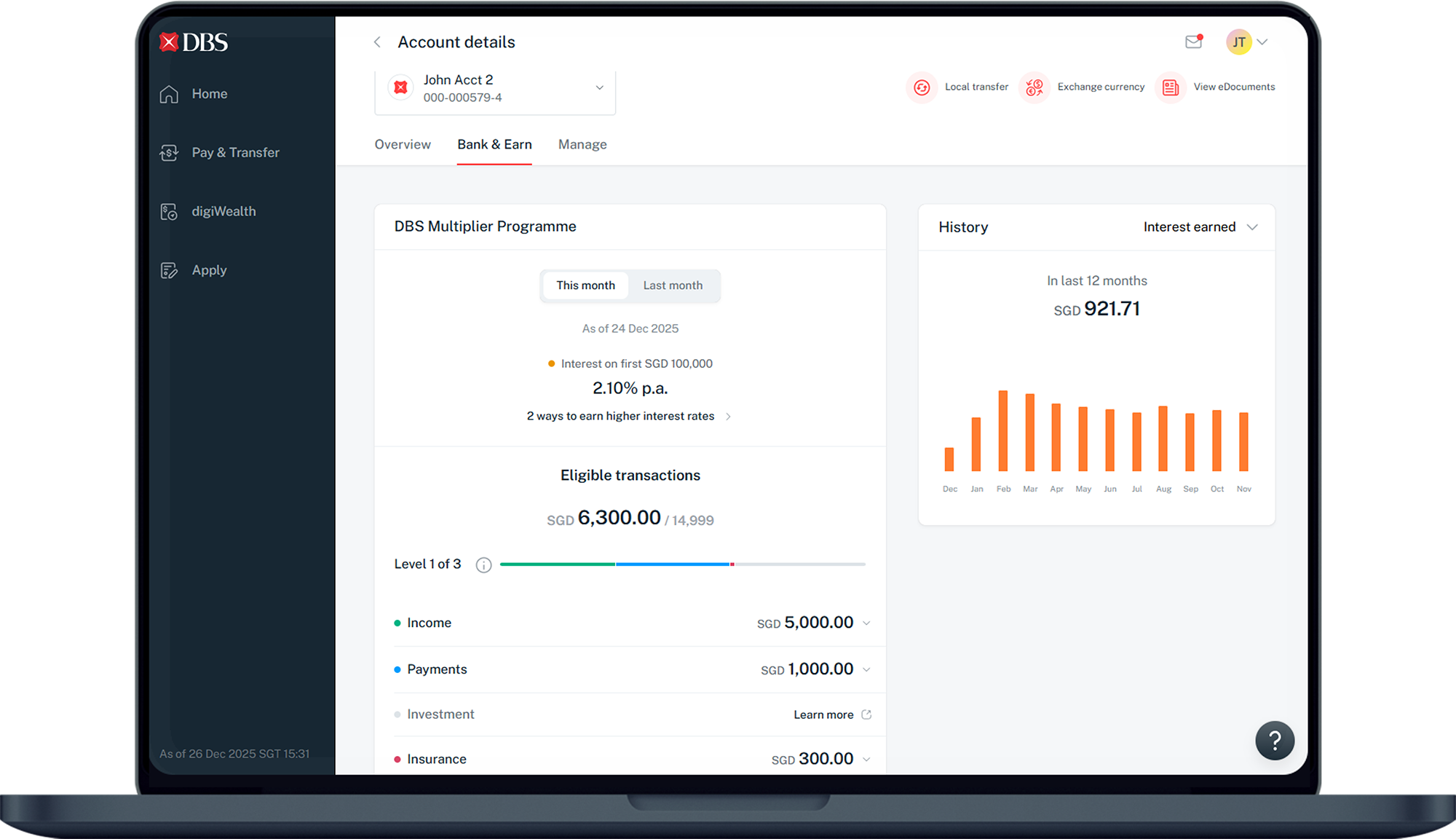

How to view my eligible transactions in Bank & Earn Summary

digibank mobile

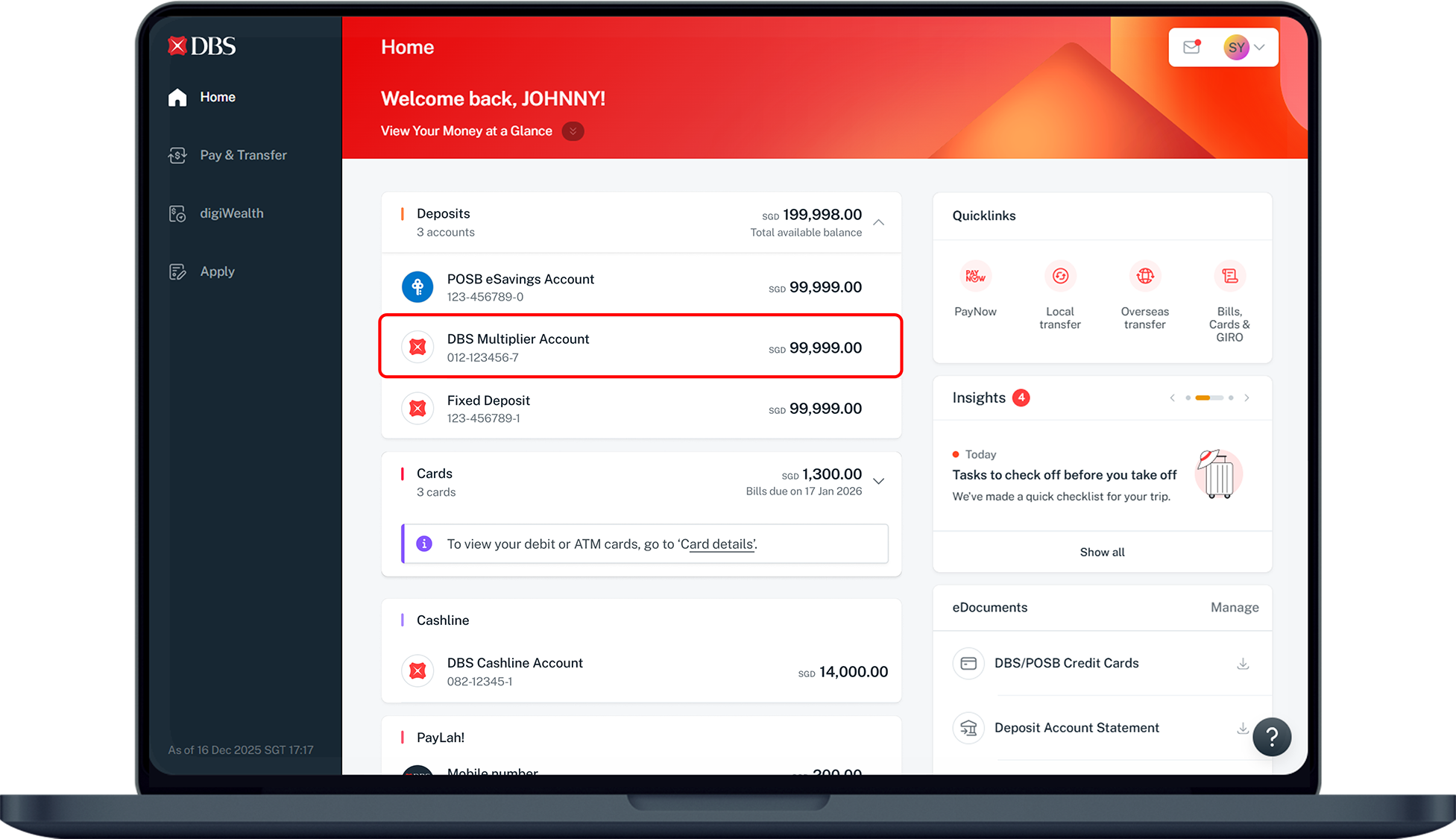

digibank online

Frequently Asked Questions

Income

Q1) What should I do if my salary credit is not recognised?

You can inform your company HR to use GIRO code 22 when they process the payroll/salary file to their corporate bank.

Q2) If I have a joint account, how will our income transactions be recognised?

The combined total salary and dividend credits in that joint account will be recognised under the individual Multiplier Accounts.

Example 1:

John and Mary credit their salaries (S$3,000 and S$3,100 respectively) and dividends (S$500 each) into their joint POSB savings account. They have their own Multiplier Accounts and are accorded a total income amount of S$7,100 each.

Example 2:

George credits his salary of S$4,000 into a joint POSB savings account shared with Emily. Emily does not have an income. They have their own Multiplier Accounts and are accorded a total income amount of S$4,000 each.

You can inform your company HR to use GIRO code 22 when they process the payroll/salary file to their corporate bank.

Q2) If I have a joint account, how will our income transactions be recognised?

The combined total salary and dividend credits in that joint account will be recognised under the individual Multiplier Accounts.

Example 1:

John and Mary credit their salaries (S$3,000 and S$3,100 respectively) and dividends (S$500 each) into their joint POSB savings account. They have their own Multiplier Accounts and are accorded a total income amount of S$7,100 each.

Example 2:

George credits his salary of S$4,000 into a joint POSB savings account shared with Emily. Emily does not have an income. They have their own Multiplier Accounts and are accorded a total income amount of S$4,000 each.

Credit Card Spend

Q1) What are the eligible credit card transactions?

Only posted retail and cash advance transactions will be recognised as eligible credit card spend. Balance transfers, instalment payment plans, preferred payment plans, and any fees / charges imposed by the bank are not eligible.

Example:

Q2) Do I have to link my Multiplier Account to my DBS/POSB Credit Card in order for my credit card transactions to be recognised?

No. Eligible credit card transactions are automatically detected across all the personal DBS/POSB Credit Cards held by you. Multiplier Account recognises credit card transactions made via American Express® /MasterCard® /Visa.

Only posted retail and cash advance transactions will be recognised as eligible credit card spend. Balance transfers, instalment payment plans, preferred payment plans, and any fees / charges imposed by the bank are not eligible.

Example:

| Transaction date: 30 Aug | Credit card spend is made at a merchant. |

| Posting date: 1 Sep | Transaction is posted to your credit card account. |

| This transaction is therefore recognised under September’s credit card spend (not August). | |

Q2) Do I have to link my Multiplier Account to my DBS/POSB Credit Card in order for my credit card transactions to be recognised?

No. Eligible credit card transactions are automatically detected across all the personal DBS/POSB Credit Cards held by you. Multiplier Account recognises credit card transactions made via American Express® /MasterCard® /Visa.

Insurance

Q1) I wish to change my premium payment frequency e.g. yearly to monthly or vice versa. Will my policy still be recognised for this month?

In the event that there are changes to the insurance policy, the monthly premium will cease to be included as an eligible transaction. This will take effect from the month where the changes are made. Changes can include but are not limited to change in premium payment frequency and reassignment of policy ownership.

Q2) I was late in paying my premium due this month. Will my policy still be recognised as eligible transaction for this month?

Yes. Your policy will still be recognised as long as your policy is still in force.

Q3) If my policy premium due is paid quarterly/annually, how is the transaction recognised?

We will derive the monthly premium amount from dividing the annualised premiums by 12.

Q4) How to check the number of eligible months that I have paid for my insurance policy?

You may view the breakdown of eligible months for your insurance transaction via Bank & Earn Summary in digibank mobile.

In the event that there are changes to the insurance policy, the monthly premium will cease to be included as an eligible transaction. This will take effect from the month where the changes are made. Changes can include but are not limited to change in premium payment frequency and reassignment of policy ownership.

Q2) I was late in paying my premium due this month. Will my policy still be recognised as eligible transaction for this month?

Yes. Your policy will still be recognised as long as your policy is still in force.

Q3) If my policy premium due is paid quarterly/annually, how is the transaction recognised?

We will derive the monthly premium amount from dividing the annualised premiums by 12.

Q4) How to check the number of eligible months that I have paid for my insurance policy?

You may view the breakdown of eligible months for your insurance transaction via Bank & Earn Summary in digibank mobile.

Investment

Q1) If my investments are in foreign currency, how will they be recognised?

Investment transactions will be recognised as the Singapore dollar equivalent at DBS’ prevailing exchange rate.

Q2) If the investment amount is deducted from a joint DBS/POSB deposit account, will the transaction be recognised for both account holders?

The transaction will be accorded to the investment applicant only.

Q3) How to check the number of eligible months that I have paid for my investment policy?

You may view the breakdown of eligible months for your investment transaction via Bank & Earn Summary in digibank mobile.

DBS Invest-Saver

Q1) Can I terminate my existing DBS Invest-Saver and re-purchase to be recognised?

No. For the re-purchase to be recognised, the fund has to be terminated and fully redeemed for at least 6 months from the date of termination or date of full redemption, whichever is later. Alternatively, you may consider purchasing a new fund to continue recognition.

Example:

Q2) I have just signed up for DBS Invest-Saver. How will it be recognised?

DBS Invest-Saver will be recognised in the same month if you sign up before the deduction date, 15th of the month (or the next business day if the 15th is a Sunday or Public Holiday). Else, it will be recognised the next month. It will be recognised for the first 12 consecutive months after the free-look/cancellation period or 4 calendar days after the settlement date.

Example:

Q3) If I change the amount of my existing DBS Invest-Saver within the 12-month period, will it be recognised?

Yes, you may update the amount and it will be recognised if deduction is successful

Q4) My DBS Invest-Saver contribution is not recognised for the month. Why is that so?

Recognition of the monthly contributions as eligible transactions will cease from the month where there is any failed deduction, or the DBS Invest-Saver is terminated.

Online Equity Trade

Q1) What transactions are ineligible for higher interest?

The following transactions are ineligible: Contra trades, sell trades, and trades executed via Trading Representatives and DBS Vickers Customer Service Line.

Q2) If I have an joint DBS Wealth Management Account, will the transaction be recognised for both account holders?

For joint DBS Wealth Management Account, the equity trades will be recognised in full for each joint account holder under their individual DBS Multiplier Accounts.

Investment transactions will be recognised as the Singapore dollar equivalent at DBS’ prevailing exchange rate.

Q2) If the investment amount is deducted from a joint DBS/POSB deposit account, will the transaction be recognised for both account holders?

The transaction will be accorded to the investment applicant only.

Q3) How to check the number of eligible months that I have paid for my investment policy?

You may view the breakdown of eligible months for your investment transaction via Bank & Earn Summary in digibank mobile.

DBS Invest-Saver

Q1) Can I terminate my existing DBS Invest-Saver and re-purchase to be recognised?

No. For the re-purchase to be recognised, the fund has to be terminated and fully redeemed for at least 6 months from the date of termination or date of full redemption, whichever is later. Alternatively, you may consider purchasing a new fund to continue recognition.

Example:

| Termination Date | 29 April |

| Full Redemption Date | 30 April |

| Re-purchase Set Up Date Re-purchase after 30 October will be recognised | |

Q2) I have just signed up for DBS Invest-Saver. How will it be recognised?

DBS Invest-Saver will be recognised in the same month if you sign up before the deduction date, 15th of the month (or the next business day if the 15th is a Sunday or Public Holiday). Else, it will be recognised the next month. It will be recognised for the first 12 consecutive months after the free-look/cancellation period or 4 calendar days after the settlement date.

Example:

| Deduction Date | 15 April (or next business day if 15th is a Sunday or Public Holiday) |

| Settlement Date | 21 April (3 to 4 working days, depending on fund house) |

| Recognition Date | 25 April (4 calendar days after the settlement date) |

Q3) If I change the amount of my existing DBS Invest-Saver within the 12-month period, will it be recognised?

Yes, you may update the amount and it will be recognised if deduction is successful

Q4) My DBS Invest-Saver contribution is not recognised for the month. Why is that so?

Recognition of the monthly contributions as eligible transactions will cease from the month where there is any failed deduction, or the DBS Invest-Saver is terminated.

Online Equity Trade

Q1) What transactions are ineligible for higher interest?

The following transactions are ineligible: Contra trades, sell trades, and trades executed via Trading Representatives and DBS Vickers Customer Service Line.

Q2) If I have an joint DBS Wealth Management Account, will the transaction be recognised for both account holders?

For joint DBS Wealth Management Account, the equity trades will be recognised in full for each joint account holder under their individual DBS Multiplier Accounts.

PayLah!

Q1) What are the eligible PayLah! Retail Spend transactions?

Non-Eligible Transactions include Peer-to-Peer (P2P) fund transfers via PayLah! message, mobile number, QR Code & Payment Link, eGift, QR Gift.

Q2) I have only PayLah! Retail Spend for the month. How will the interest be computed?

Preferential interest will be accorded to age 29 years old and below. You may refer to FAQs for Multiplier for more information.

Q3) My salary is credited to DBS/POSB account and I have PayLah! Retail Spend for the month. How will the interest be computed?

You may refer to FAQs for Multiplier for more information.

Non-Eligible Transactions include Peer-to-Peer (P2P) fund transfers via PayLah! message, mobile number, QR Code & Payment Link, eGift, QR Gift.

Q2) I have only PayLah! Retail Spend for the month. How will the interest be computed?

Preferential interest will be accorded to age 29 years old and below. You may refer to FAQs for Multiplier for more information.

Q3) My salary is credited to DBS/POSB account and I have PayLah! Retail Spend for the month. How will the interest be computed?

You may refer to FAQs for Multiplier for more information.

Was this information useful?