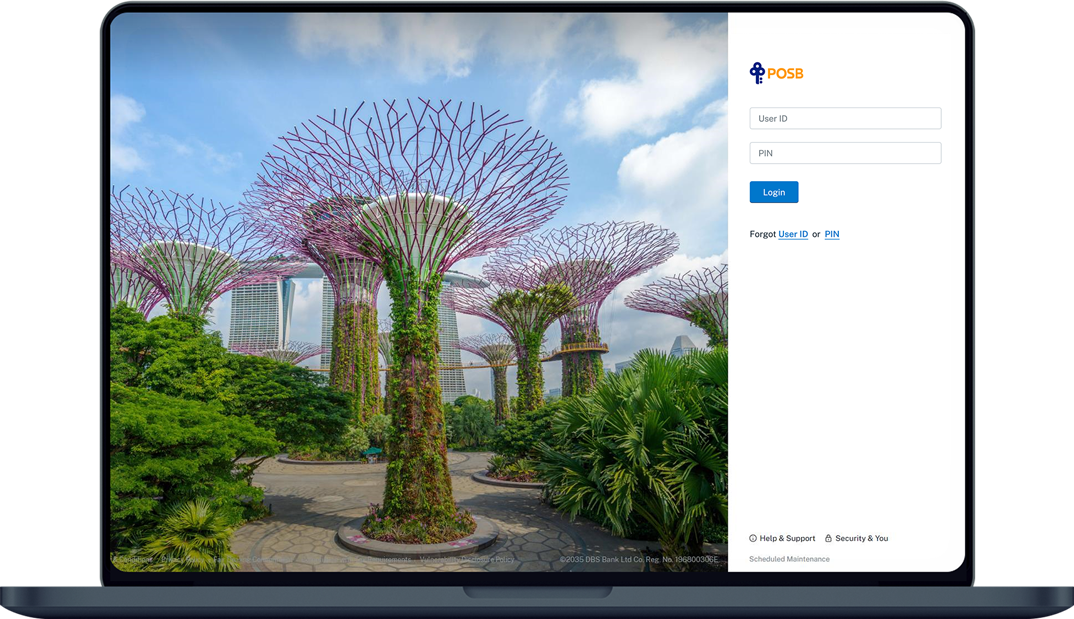

Fixed Deposit Premature Withdrawal

Learn how to make a premature withdrawal from your DBS Fixed Deposit Account via digibank online.

Important information

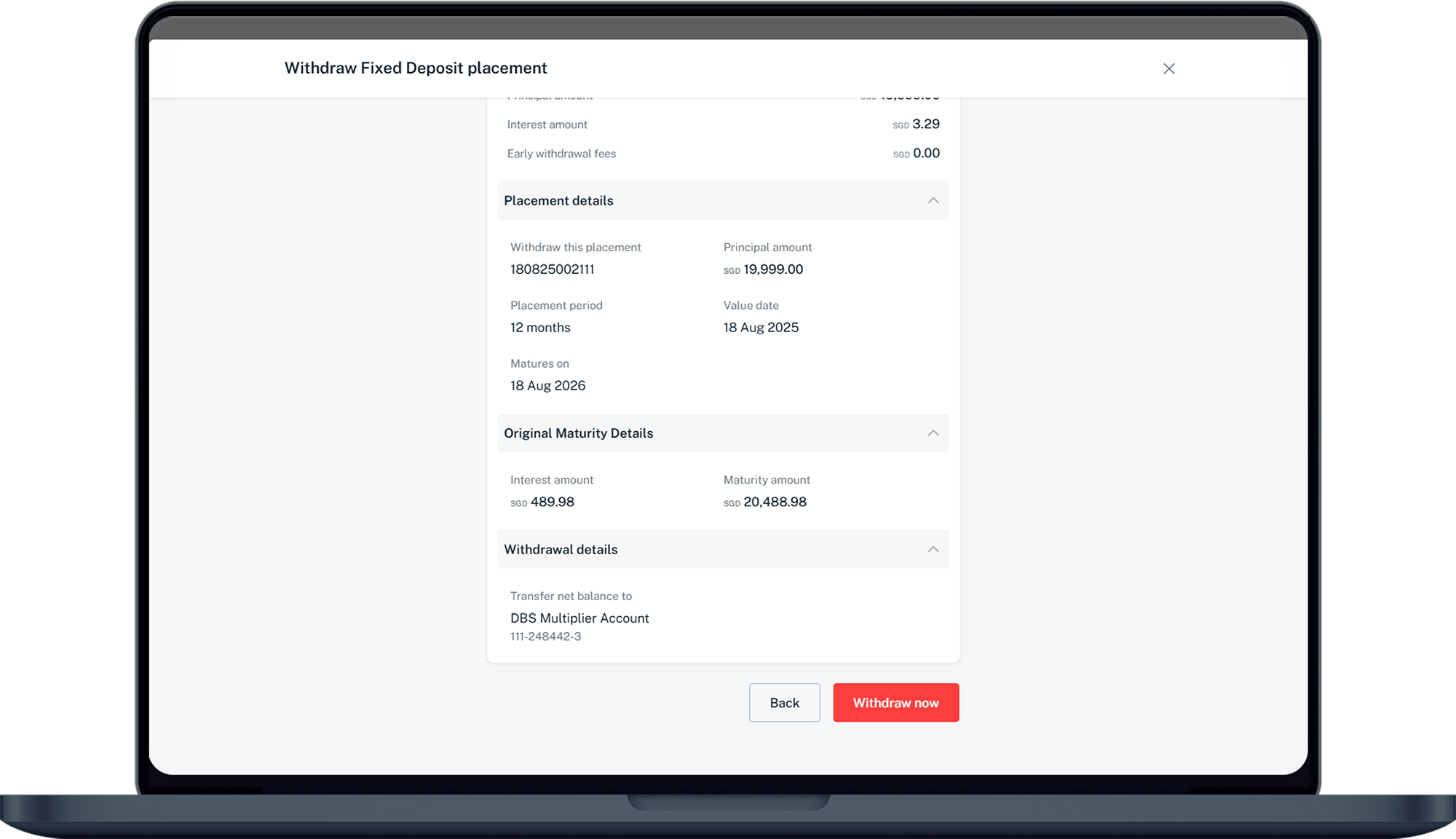

- For premature withdrawals of SGD Fixed Deposits, any interest will be calculated at the Bank's lowest applicable deposit rate, subject to change. For premature withdrawals of foreign currency Fixed Deposits, no interest will be payable

- For SGD Fixed Deposit, you will be able to check the interest received during your Fixed Deposit premature withdrawal request via digibank.

- The principal and interest will be renewed automatically based on the same tenor at the prevailing interest rate, unless you provide us with other instructions at least 1 working day before the maturity via digibank.

- Withdrawal of SGD and/or Foreign Currency Fixed Deposit placement is not allowed on the day of maturity or 1 day before maturity date.

(For withdrawal of Foreign Currency Fixed Deposit, please bring along NRIC/Passport to nearest full service branches.)

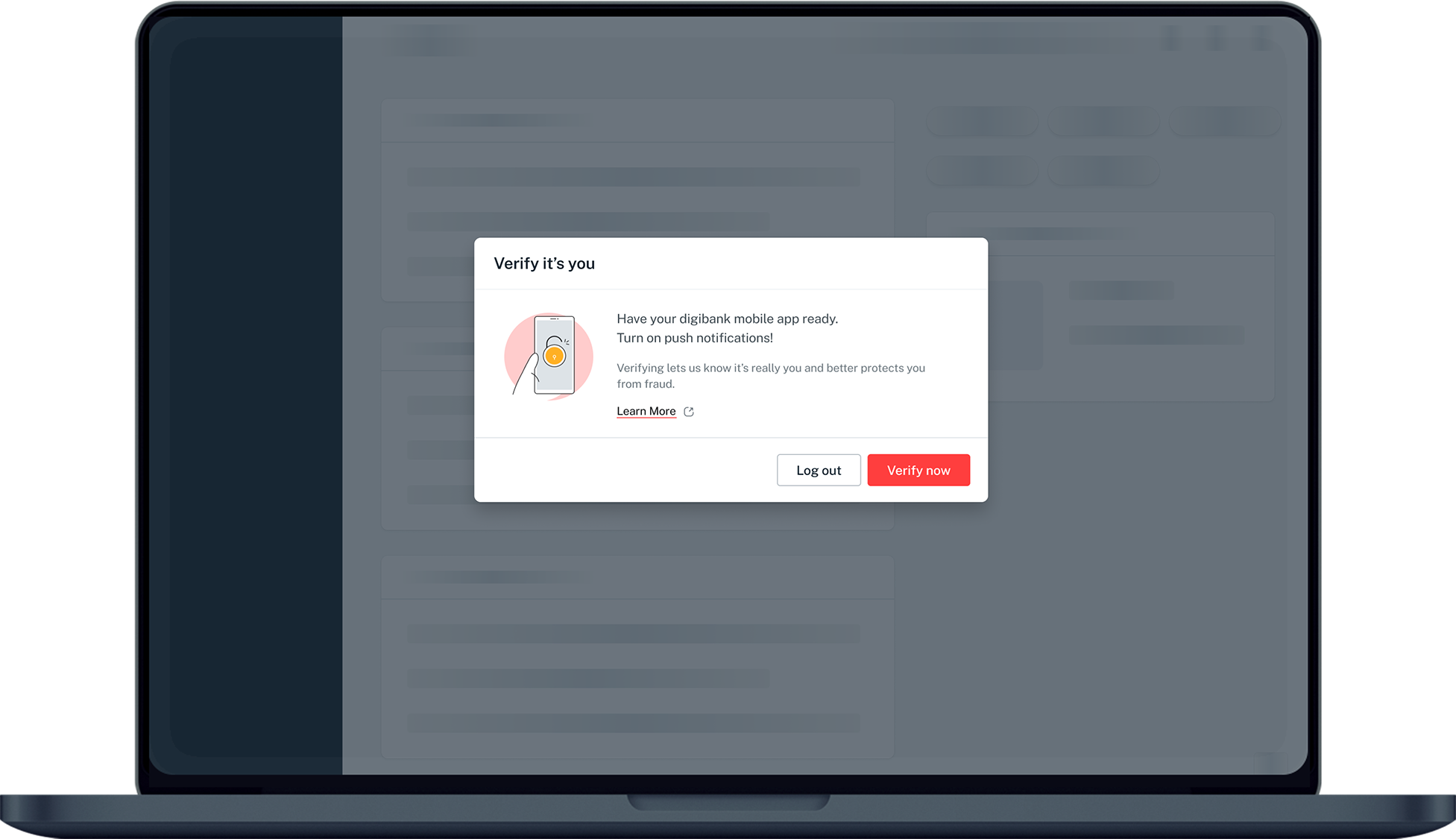

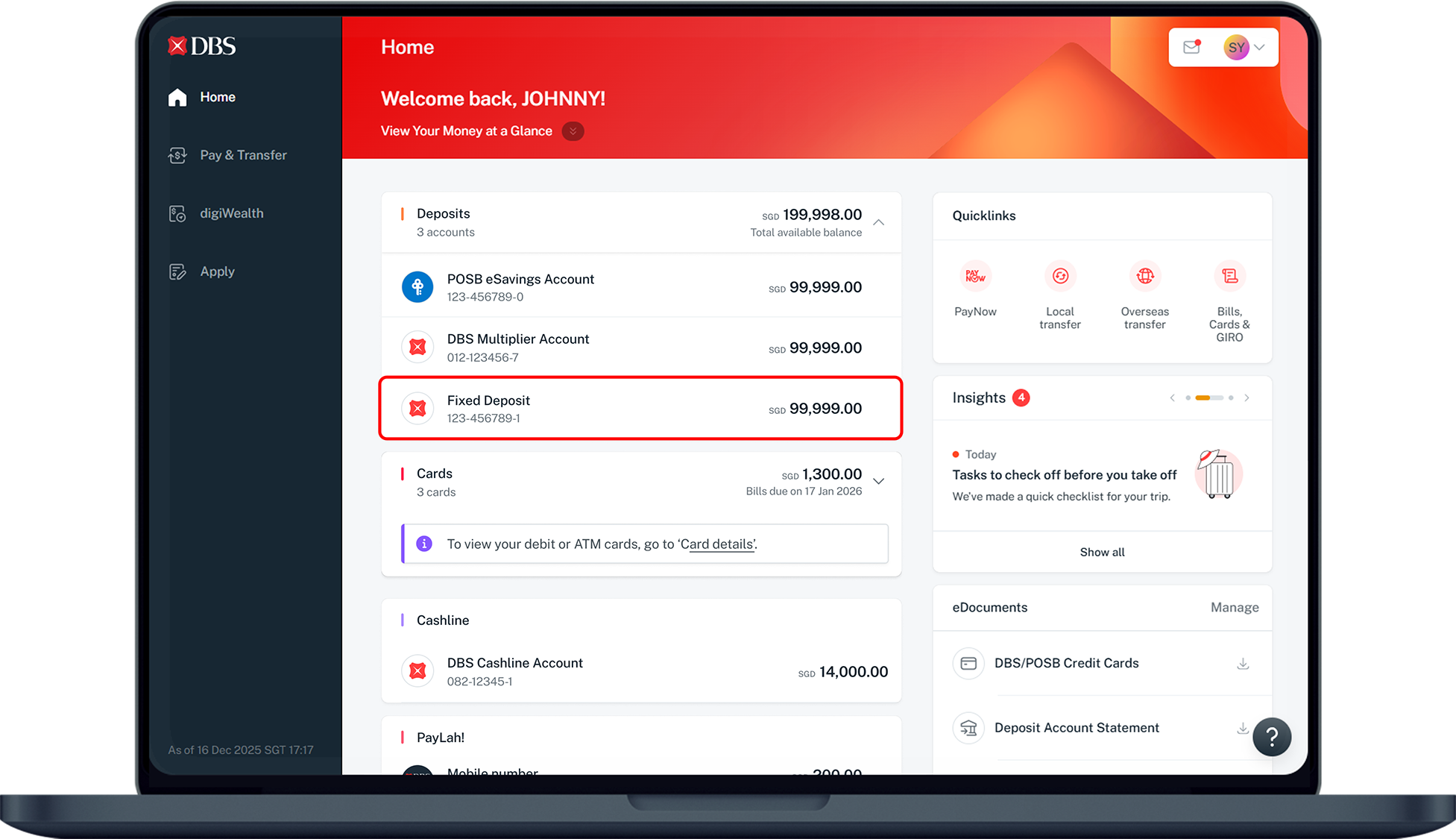

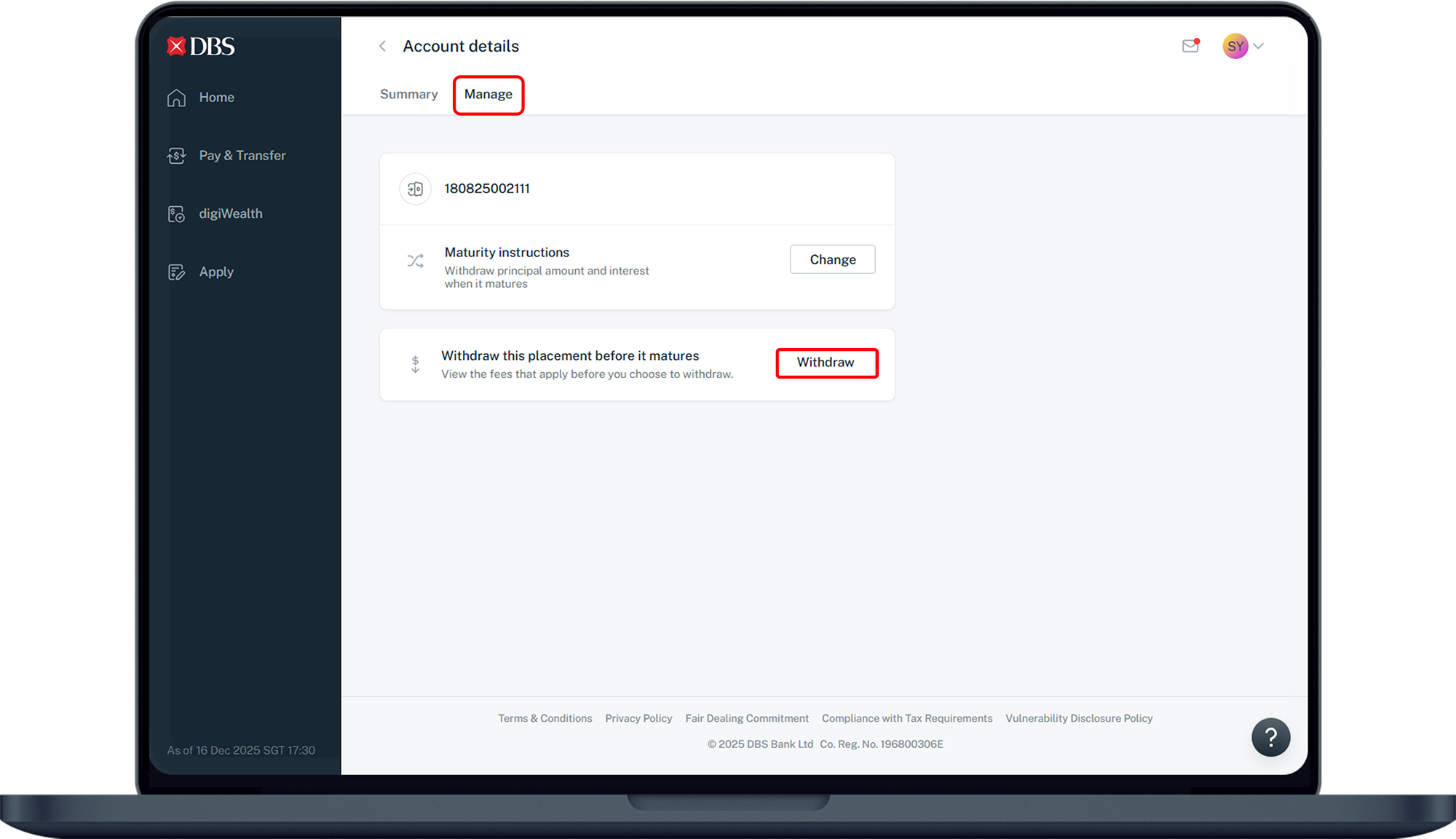

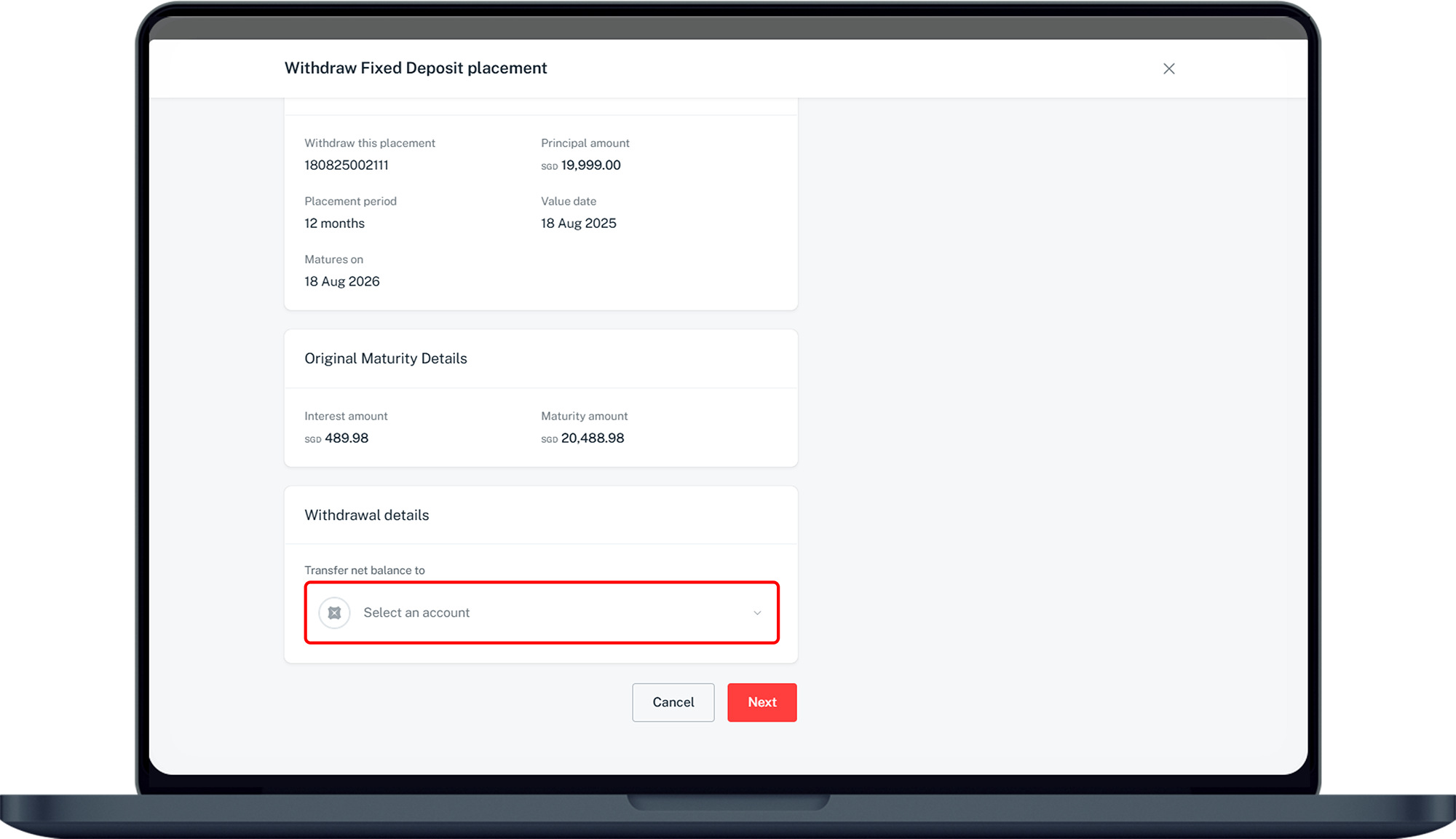

How to withdraw an SGD Fixed Deposit prematurely

digibank online

More information

- This service may be unavailable from 11.00pm to 5.00am daily, and on the last working day of the month from 8.00pm to 5.00am.

- Foreign Currency Fixed Deposit, SRS SGD Fixed Deposit and SGD Structured Deposit accounts are not eligible for withdrawal via this service.

Was this information useful?