Enjoy up to 2% p.a. interest rate for amounts S$50k and below.

| Balances | Interest Rates (% p.a.) |

|---|---|

| First $10,000 | 1.00 |

| Next $40,000 | 2.00 |

| Above $50,000 | 0.05 |

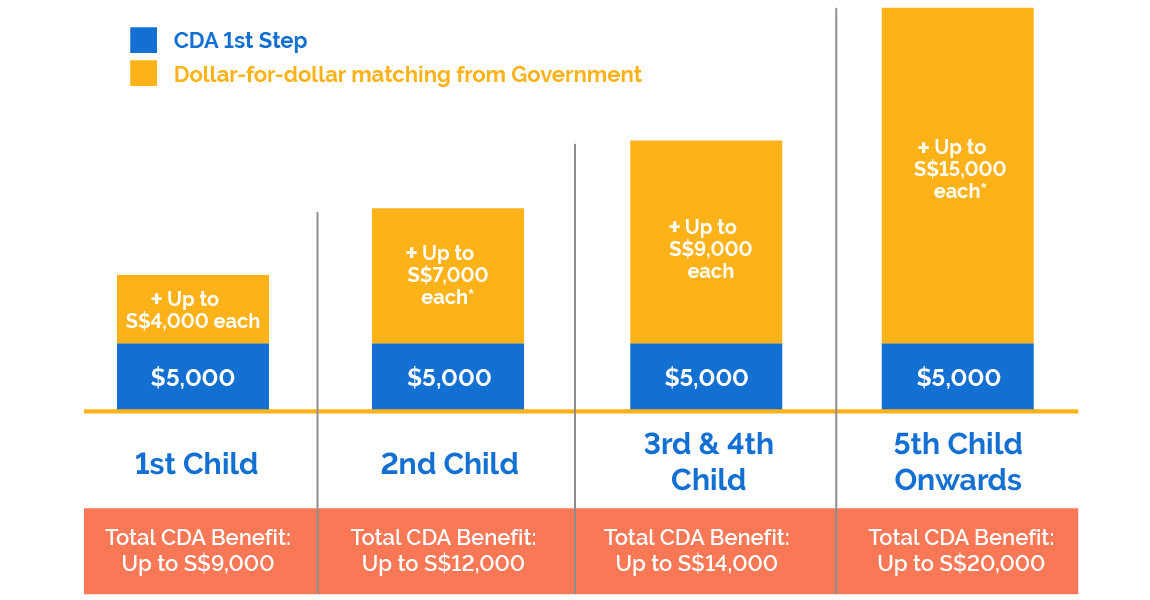

Babies born on or after 14 February 2023 will receive S$5,000 of CDA First Step grant when you open the POSB Smiley CDA. The Government will match every dollar you put in this account.

* The Government will increase its dollar-for-dollar matching cap from S$3,000 to S$4,000 for all Singaporean children who are a first child, from S$6,000 to S$7,000, for all Singaporean children who are a second child and whose date of birth is on or after 14 February 2023. Parents will receive the enhanced Baby Bonus benefits from 1 August 2023.

You will be able to deposit savings in the CDA until 31 December in the year your child turns 12 years old. The unused balance in your child's CDA will be transferred to his or her Post-Secondary Education Account (PSEA) in the following year. These funds can then be used to pay for post- secondary education fees in Singapore for your child and his or her siblings.

More for your little one, from the government.

Use funds from the POSB Smiley CDA to pay for childcare or medical expenses at Approved Institutions (AIs) registered with the Ministry of Social and Family Development (MSF) via NETS or interbank GIRO.

SMS to 77767:

Activate <space> card's last 4 digits <space> SG

SMS to 77767:

Activate <space> card's last 4 digits <space> SG <space> SG

Frequently Asked Questions

How do I join the Baby Bonus Scheme?

Either parent may join the scheme at www.babybonus.msf.gov.sg with his/her SingPass.

Both parents will have to agree on the person (either parent and/or a third party) to:- Receive the cash gifts (as a Nominated Bank Account Holder)

- Manage the Child Development Account (as a CDA trustee).

The Cash Gift bank account holder and CDA trustee can be the same person or different persons. The CDA trustee has to be above the age of 18 and not a bankrupt.

What documents do I need to join the Baby Bonus Scheme?

If your child is a Singapore citizen at birth and joins the scheme 1 working day after the birth registration, we will have the details of both you (parents) and your child. You will need to complete an online form and provide your bank account number to receive the cash gift.

Additional information required for third party Cash Gift bank account holder and CDA trustee are:- Personal particulars

- Bank account details

I need some help to join the Baby Bonus Scheme online. Who can I approach?

You can approach:

- [After your child's birth registration] Baby Bonus One-stop Centres at the Immigration & Checkpoints Authority of Singapore (ICA) and maternity hospitals*

- Citizen Connect Centres

- MSF Family Services Division at 512A Thomson Road, #02-01/09 SLF Podium, Singapore 298137

*Note: Gleneagles Hospital, KK Women's and Children's Hospital, Mount Alvernia Hospital, Mount Elizabeth Hospital, Mount Elizabeth Novena Hospital, National University Hospital, Parkway East Hospital, Raffles Hospital, Singapore General Hospital, Thomson Medical Centre.

How can I open a CDA?

If you are the parent of the child and a Singaporean, you can open the CDA online. When you log in to Baby Bonus Online (BBO) to join the scheme, you will need to indicate the CDA trustee. If you are the CDA trustee, you can proceed to select POSB/DBS Bank and accept the Terms and Conditions of the selected CDA bank.

If you indicate that your spouse is a CDA trustee, your spouse (CDA trustee) will receive a Baby Bonus link by email to accept the Terms and Conditions of the selected CDA bank online.

The CDA will be automatically opened within 3 working days after the CDA trustee accepts the Terms and Conditions of the selected CDA bank online.

If the CDA trustee is a foreigner or a third party trustee, we will send him or her an authorisation letter to open the CDA at any CDA bank branch.

The trustee must produce:

- The original authorisation letter

- Trustee's NRIC or passport

- A copy of the child's birth certificate or certificate of Singapore citizenship (whichever is applicable).

Can I open a new CDA directly with any of the CDA banks?

You will have to log in to Baby Bonus Online to open a new CDA or change a CDA bank online.

For a foreigner or a third party trustee, you will receive an authorisation letter from MSF to open a new CDA directly with the selected CDA bank.

How can I change my CDA bank?

The CDA trustee (including third party trustee) can log in with their SingPass to submit a request for change of CDA bank, using <"Change CDA bank"> service. Funds will be transferred from the old CDA to the new CDA within 3 weeks.

Note: A CDA trustee who is not a Singapore Citizen must submit request for change of CDA bank in writing to [email protected]. A Letter of Authorisation will be sent to CDA trustee to open the CDA at the new CDA bank.

Can my GIRO arrangements be transferred to the new CDA?

You will have to:

- Update your Approved Institution (AI) of the new CDA number by completing a new 'Application for Interbank GIRO for Child Development Account (CDA)' and submit it to your AI. You may find the form at www.babybonus.msf.gov.sg.

- Ensure that there are sufficient funds in the new CDA in the interim period while the funds are being transferred.

How can I change the CDA trustee?

The CDA trustee must log in with the SingPass to submit a change of trustee using the <"Change CDA Trustee"> service.

Note: If the CDA trustee is a 3rd party, only the parent can log in to submit the request. If the CDA trustee is not a Singapore Citizen, he/she must submit request for change of CDA trustee in writing to [email protected].

I have changed my name/child's name. Do I need to inform MSF and my CDA bank?

Yes. Please email to [email protected], with copies of the deed poll or Certificate of Extract from Registry of Births.

The CDA trustee will also need to update the CDA bank separately by bringing the original deed poll or Certificate of Extract from Registry of Births to the bank branch, as the bank would need to see the original document(s).

When can I receive the Government's matching contribution in my child's CDA?

You can receive the Government's matching contribution within 2 weeks after depositing savings into your child's CDA. You can also select 'View Account Summary' under Services, to check your child's CDA transactions.

How much can I save in the CDA?

When parents save in the CDA, the Government will match dollar-for-dollar in the CDA for up to:

- $7,000 for the first child* and second child

- $9,000 for the third and fourth child

- $15,000 for fifth and subsequent child*.

For example, if you deposit $10 into the CDA in July 2015, the Government will match $10 within 2 weeks after you begin saving in your child's CDA.

*Note: Children born between 1 Jan 2006 to 16 Aug 2008, who are the first child or fifth child (and above), are not eligible for Government's matching contribution in the Child Development Accounts (CDAs).

How can I save in the CDA?

You can save in the CDA in any of the following ways:

- Cash, cheque or by Standing Order

- Funds transfer through the local ATMs or internet banking.

How can I view my CDA transactions?

You can view the transactions with Internet Banking. Alternatively, you can also select 'View Account Summary' under Services, to check your child's CDA payment.