![]()

If you’ve only got a minute:

- Set aside at least 10% of your income and revise your budget for new expenses and financial responsibilities.

- Use Multiplier to access better interest rates.

- Grow your wealth over time by investing through POSB Invest-Saver or POSB Vickers.

![]()

Starting your first job and unsure how to handle your new income? Take the first step to financial independence with these simple tips.

Track your spending habits and patterns

Managing your finances is a key part of becoming independent. A great way to start your financial journey is by prioritising savings by setting aside at least 10% of your salary once you receive it.

It’s equally important to create a budget and track your spending. As you transition from student life to working life, you’ll likely face higher expenses – mobile phone plans (standard rate) or upgrading to a work-appropriate device, daily commuting and/or more frequent social outings with colleagues.

You may also face new responsibilities such as taking over insurance plans from your parents, paying rent and utilities if you move out or covering moving expenses for a new job location.

To make things easier, the digibank app features a Plan & Invest tab - a smart financial planning tool that helps you track your expenses and manage your savings, ensuring you stay on top of your finances as your responsibilities grow.

Read more: Track your savings and spending with digibank

Upgrade your childhood savings account

Childhood savings accounts often have little to no interest because they are designed primarily for basic banking needs and typically offer minimal features for long-term savings or investment growth.

To enhance your savings potential, consider upgrading to accounts like the Multiplier.

If you’re a freelancer without a regular salary, you can direct any investment dividends as part of the “income” category.

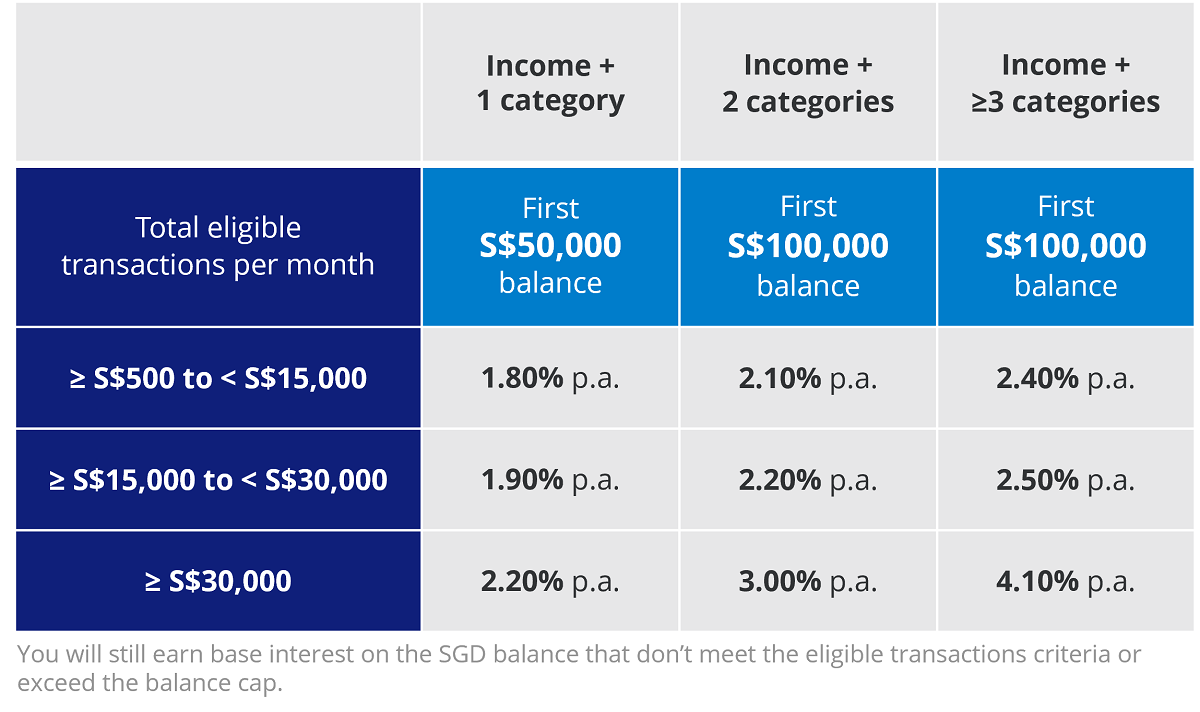

You can earn up to 4.1% p.a. by crediting your salary into your DBS/POSB account and meeting 1 or more of the qualifying categories: credit card/PayLah! Retail spend, an instalment, insurance premiums, and/or investments.

Engaging in these transactions can elevate your interest earnings, especially when your total eligible transactions exceed S$500 per month.

Remember, the more you engage with these activities, the stronger your interest earning potential becomes.

Applying for the Multiplier is hassle-free and can be done online.

If you’re age 29 or younger, the “fall-below” service fee is waived. The “fall-below” service fee is a service charge of S$5 per month, which applies only if your average daily balance falls below S$3,000 (inclusive of SGD equivalent of foreign currency balance).

Upgrade to your own credit card

As a new jobber, obtaining your own credit card marks a significant step towards financial independence. Moving beyond a debit card, a credit card offers numerous advantages such as accumulation of points, cashback, rewards and/or miles (travel benefits) on your purchases.

A standout option is the LiveFresh Card, designed to reward you for both your daily lifestyle spending and your adventures abroad. It offers cashback on shopping and daily needs (public transport), unlimited cashback on all eligible spend and zero FX fees on overseas transactions.

More importantly, it also qualifies you for higher interest rate with the Multiplier (no minimum spend on your POSB/DBS credit card required).

Example:

Jack is a first jobber who credits his monthly salary of S$3,500 into his DBS/POSB savings account and transacts across 2 categories.

His total qualifying transactions amount to S$3,800, earning him a bonus interest rate of:

- 2.10% p.a. for the first S$100,000 and

- A base interest rate for balances above S$100,000.

To unlock higher interest rates (2.10% p.a. to 2.40% p.a.), Jack can purchase an insurance policy for protection (transact across 3 categories).

Stay protected

Getting insurance when you’re young or have just started working is important for several reasons.

Life and term insurance premiums are generally lower when you’re younger and healthier and tend to increase with age or when health issues arise.

Additionally, an endowment policy can help you build wealth as it leverages compound interest, helping you to achieve milestones like marriage and first home goals sooner.

Lastly, buying an insurance policy from POSB/DBS not only helps you meet a vital protection need but also fulfils another DBS Multiplier criteria, allowing you to potentially earn higher interest rates. For example, Jack’s interest rate increases from 2.10% p.a to 2.40% p.a when he transacts in 3 categories instead of 2. (To see how much you can potentially earn, try our calculator here.)

Elevate your travel experience

Even if you’re just beginning your professional journey, it won’t be long before you find yourself yearning for a respite.

Elevate your travel experience by using the multi-currency feature available within your bank account. If you have the Multiplier account, simply lock in your preferred exchange rate, link it to a Visa debit card, and you’re equipped to transact seamlessly overseas.

Grow with the flow

One of the best financial moves you can make early in your career is to start investing for the long haul. A longer-term approach mitigates the impact of short-term market fluctuations, offers time to recover from downturns and typically yield better returns. In addition, giving your investments time to compound the interests/dividends definitely gives you more bang for your buck.

Consider POSB Invest-Saver, a regular savings plan that lets you invest a fixed sum regularly into your choice of investments, from as little as S$100 a month.

You can also use DBS Invest-Saver to invest in ETFs or make a lump-sum investment in unit trusts. Both qualifies you for the investment category in the months you transact.

Alternatively, consider stock trading via your POSB Vickers account (your stock purchases and dividends will contribute towards the Multiplier).

Read more: I'm ready to invest, how can I start?