![]()

If you’ve only got a minute:

- Critical illness (CI) insurance provides the insured with a one-time payout upon diagnosis of a specified CI, like a heart attack, stroke, or cancer.

- Early and intermediate stage CI are covered under early CI insurance plans while multi-pay CI plans offer protection for multiple or recurring diagnoses.

- Before buying CI insurance, do remember to consider your budget, family medical history and desired coverage needs.

![]()

According to the Ministry of Health, cancer accounts for a quarter of all deaths in Singapore. Studies indicate over 90% of severe-stage insurance claims submitted are related to 3 major critical illnesses (CI): cancer, heart attack and related conditions, and stroke (Gen Re Dread Disease Survey).

These figures suggest show that the decision to have CI coverage is a key consideration of financial planning. Simply having insurance isn’t enough—what truly matters is having adequate coverage to protect against financial strain in the event of a CI diagnosis.

What is Critical Illness (CI) insurance?

CI insurance provides a lump sum payout upon diagnosis of a covered condition. The Life Insurance Association Singapore (LIA) has a standardised list of 37 severe-stage CI covered by such policies. However, coverage for the early and intermediate stages of these illnesses is not fixed and may vary between insurers.

Hospitalisation plans like Medishield Life or private integrated shield plans (IPs) can help cover your medical expenses, but they typically don’t extend to the broader costs associated with serious illnesses. These additional expenses may include lost income, domestic help, or alternative treatments that aren’t covered by standard health insurance.

When a person is diagnosed with a CI, the financial impact can be significant, especially if they need to stop working or incur additional costs. A lump sum payout from a CI policy can provide valuable financial support during such a difficult time.

Types of CI Insurance

There are several types of CI policies available, each offering different levels of coverage and benefits.

1. Conventional CI Plans vs. Early CI Coverage

Traditional CI plans typically cover severe or late-stage illnesses. These plans are often more affordable and provide crucial financial support during the later stages of illness.

However, with advancements in medical screenings and early detection, more people are being diagnosed with CI at earlier stages. Early CI plans extend coverage to include these early and intermediate stages, though they generally come at a higher cost. These policies are particularly useful for younger individuals (in their 20s or 30s) as they have relatively lower level of savings and the premiums of an early CI plan would be more affordable.

2. Single-Pay vs. Multi-Pay CI Plans

Traditional CI policies generally provide a one-time payout upon diagnosis of a CI. Once the claim is paid, the policy ends, leaving the insured without coverage for future claims. This can create a gap in coverage if the illness recurs or if another CI is diagnosed.

Multi-pay CI plans, on the other hand, provide multiple payouts over time. This is especially useful if a CI returns or if the insured is diagnosed with another type of illness. These plans can help cover ongoing treatment costs and provide financial support in the long term.

However, multi-pay plans tend to have higher premiums and more complex terms. Be sure to weigh the costs and benefits before deciding whether this type of plan is right for you.

Find out more about: Manulife Early CompleteCare

Considerations when choosing a CI plan

1. How much coverage do you need?

According to the MAS Basic Financial Planning Guide, you should aim for coverage of at least four times your annual income for late-stage CI. This amount can help replace lost income and provide financial support while you focus on recovery.

The payout from your CI policy can also cover costs not included in your hospitalisation plan, such as alternative treatments or special equipment. Additionally, it can help with ongoing expenses like mortgage payments or hiring domestic help.

2. Which type of CI plan is right for you?

While basic CI policies are essential for most people, early CI or multi-pay plans may be worth considering if your budget allows. However, the most important coverage for CI is still a comprehensive health insurance plan, such as an Integrated Shield Plan, which can cover a wide range of medical expenses.

Read more: Why you need CI Insurance

3. Consider your family's medical history

Understanding your family’s medical history can give you a better idea of your potential risk for certain CI. For example, if cancer runs in your family, you might consider a multi-pay CI plan or one that specifically covers cancer-related illnesses. There are also CI plans tailored to cover women-specific health issues.

4. Assess your budget and needs

Insurance policies require a long-term financial commitment. It’s important to regularly review your coverage needs with your advisor to ensure you can continue to meet both your premium payments and your long-term financial goals.

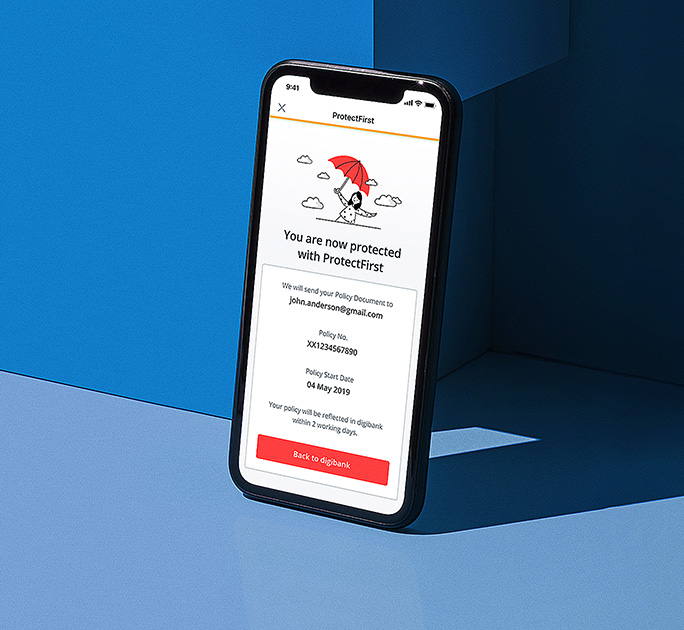

DBS has partnered with major insurers in Singapore to make health insurance easily accessible online for purchase. You can now independently learn, compare and buy a plan most suited to your own needs. Find out more on DBS Health Marketplace.