Connect all your

finances with ease

finances with ease

insurance, SGX CDP, CPF, and IRAS instantly.

finances with ease

Frequently asked questions

The consent period lasts 1 year (365 days), starting from the day you successfully link your first financial institution. From 6 Nov 2023, the consent period will be automatically extended for 1 year, every time you sync your data with any financial institutions*. For example, if you provide consent on 7 Nov 2023 for Bank A and B to release your information and subsequently sync your data for bank B only on 1 Dec 2023, consent for both banks will last till 30 Nov 2024 instead of 6 Nov 2024.

The SGFinDex T&Cs governing will be revised in accordance to this change from 6 Nov 2023. Refer to full T&Cs here.

If you change your mind about having your accounts linked, you can revoke consent for any bank at any time.

*Except UOB, which the auto renewal of consent will be made available from 10 Nov 2023, as well as HSBC Bank (Singapore) and Standard Chartered Bank, from 1 Dec 2023. During this period, your data from UOB, HSBC Bank and Standard Chartered Bank will not be retrieved or refreshed through SGFinDex. For further information, please contact the respective banks.

You’ll need to first log in to the information-sharing platform with your SingPass. Select a bank, insurer or SGX CDP to connect and log in to that financial institution page with your login credentials to provide consent to link your accounts.

Once that’s done, you’ll need to log in with your SingPass again as an added security measure. POSB NAV Planner can then securely retrieve and store your information.

You do not need to link your DBS/POSB accounts with SGFinDex if you use POSB NAV Planner.

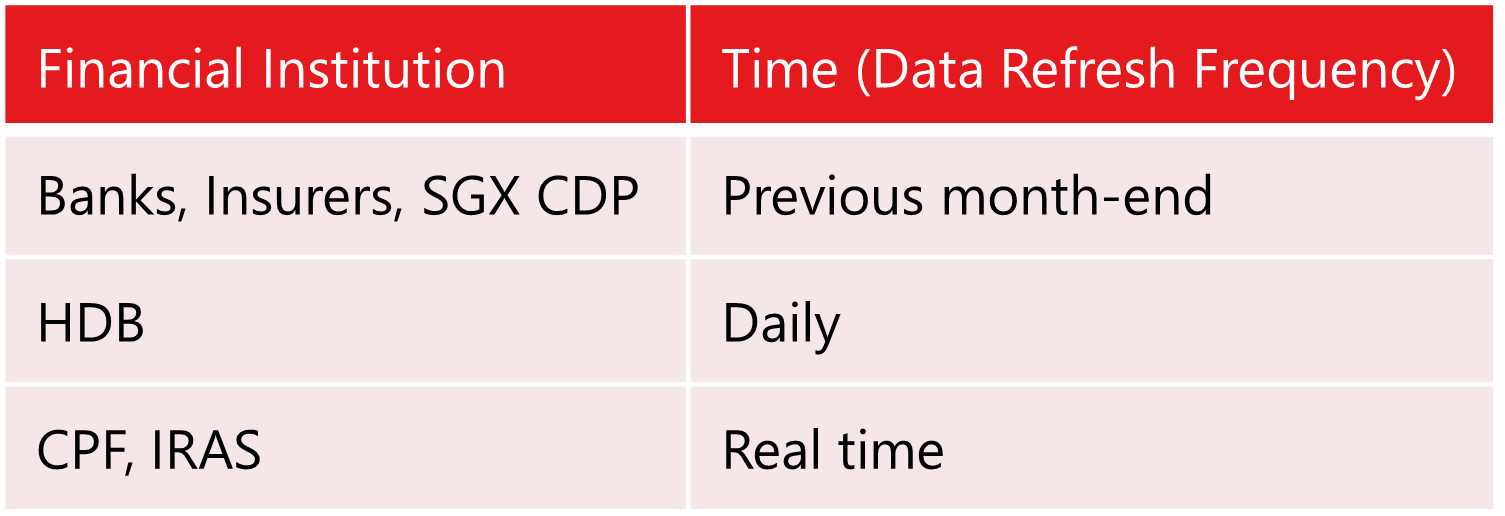

All banks’ and insurers’ financial information shared is as of the previous month-end or previous monthly statement balance, where applicable.

CPF and HDB information is latest as at the day you connect or refresh.

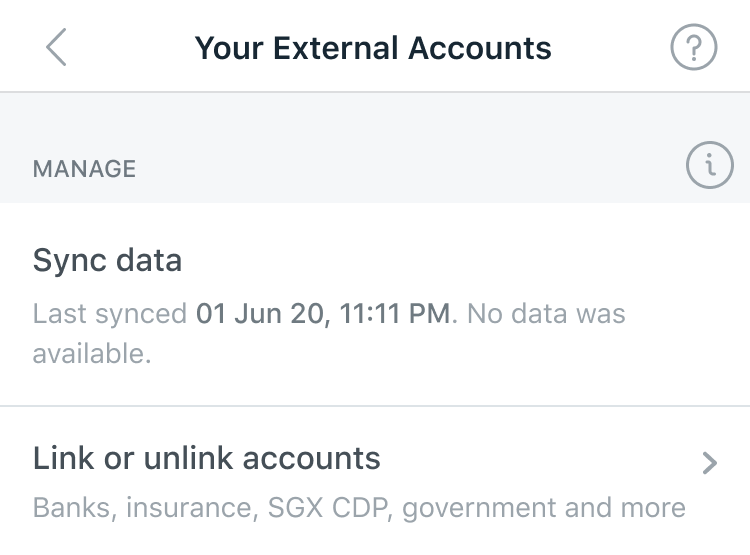

Your information is updated only when you tap on the ‘SYNC’ button within POSB NAV Planner

Found in Net Worth, Insurance, Save and Plan Settings.

No, you’ll only be able to view your information from banks, Insurers, CPF, HDB and IRAS. You won’t be able to perform any transactions.

Information will only be shared through SGFinDex after you provide your consent to link your participating financial institution with SGFinDex and also request for information retrieval of the linked accounts through financial planning applications/websites such as POSB NAV Planner.

Your information can only be retrieved upon your instruction to do so. When you retrieve your information from other financial institution through POSB NAV Planner, your DBS financial information will NOT be automatically shared with other institution in return.

SGFinDex does not store or have access to your financial information.

You can refresh your data by clicking on the ‘SYNC’ button found through NAV planner or the ‘Link or unlink accounts’ button from the Plan Settings page.

Nevertheless, you can still use Bank A, B or C financial planning applications/ websites to retrieve and consolidate data from both Bank B and Bank C, in addition to your MyInfo data.