Note: To qualify, you must register and have your first salary credit in your POSB/DBS account by 31 Oct 2026.

Step 1:

Credit income.

Step 2:

Transact in 1 or more categories.

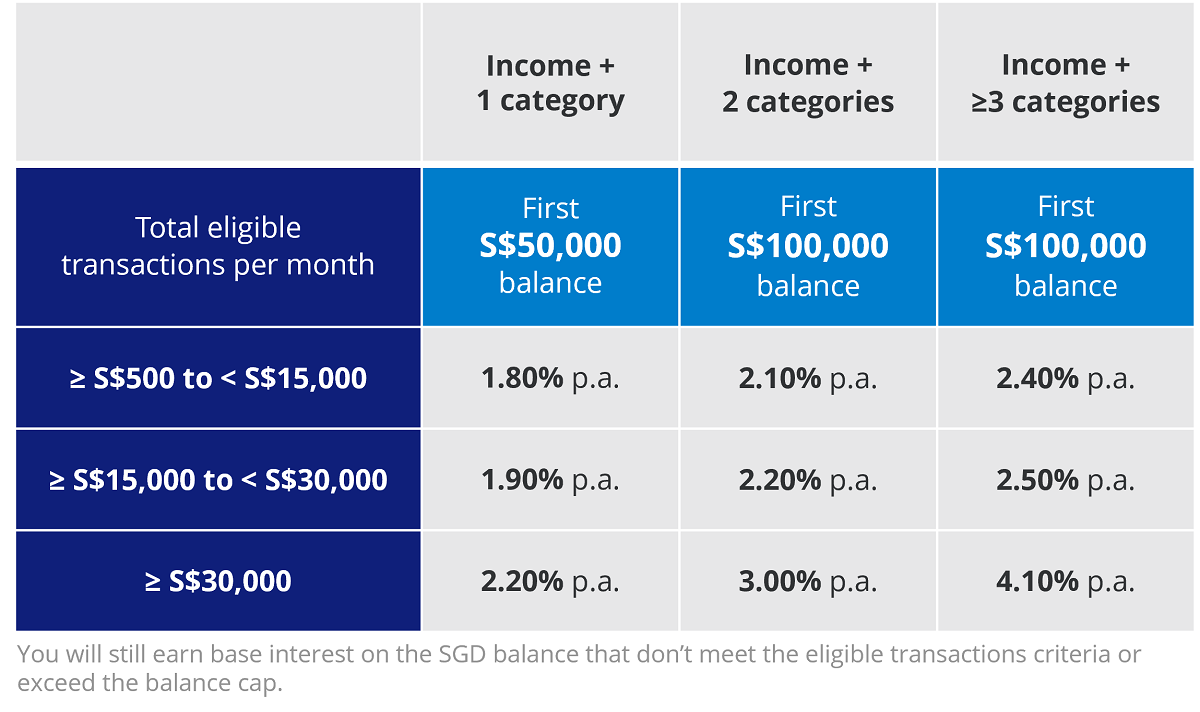

You can still earn bonus interest without an income!

Earn 1.50% p.a. on first S$50,000 balance with any Credit Card/ PayLah! Retail Spend. This applies to you if you’re 29 years old and below.

Ready to hop over? Apply for Multiplier now!

Open a Multiplier Account instantly on digibank app

Singaporeans, Permanent Residents, and Foreigners (EP/SP/DP /Long Term Visit Pass/Student Pass) can open a Multiplier Account instantly with Singpass.

On DBS? Click here to apply.

Tapping the button above will direct you via OneLink to an app store, a third-party site, to download digibank. Read our disclaimer on accessing third-party sites here.

Alternatively, launch your digibank app, tap on More and tap on Deposit Accounts under the Apply section.

| Stand a chance to receive up to S$2,828 or a Prosperity Horse Medallion Set (worth S$98) for both you and the first paired recipient of your eGift or QR Ang Bao. Simply send an eGift or QR Ang Bao (minimum S$8) with DBS PayLah! AND keep your total cash withdrawals below S$500 OR deposit a minimum of S$8,000 in fresh funds into Multiplier or any other DBS/POSB Account(s) between 27 Jan to 10 Mar 2026. Terms and conditions apply. Participation in the promotion is limited only to those who have fulfilled the promotion criteria. First paired recipient refers to either the first person to receive your eGift or redeem your loaded QR Ang Bao during the campaign period. The QR Ang Bao must also be loaded during the campaign period. |