PAssion POSB Debit Card

Mandai Wildlife Group: With effect from 1 December 2023, only online ticketing purchases will be eligible for up to 9% cash rebates.

Get 1% cashback at Takashimaya Department Store and Takashimaya Square, B2.

No minimum spend required. Click here for terms and conditions.

PAssion Membership Privileges

Enjoy free PAssion membership1 (worth S$12) which comes with these privileges:

- Member rates for all Community Club courses, activities and facilities, and privileges at other PA outlets (PAssion WaVe, Chingay Parade and more)

- Discounts at over 2,000 PAssion Merchant outlets

- Complimentary National Library Board Partner Membership which entitles you to borrow up to 24 library items2

- Redeem a $5 eCapitaVoucher3 at only 4,500 STAR$®

Under the PAssion CARES initiative4, you can now earn yuu points when you tap your PAssion POSB Debit Card at the PAssion CARES terminals or scan the PAssion CARES QR Code located at selected community events. With every successful tap or scan, you will receive 10 yuu points. POSB and yuu Rewards club will contribute another 10 yuu points towards a good cause. Start doing your part for charity by tapping your card or scanning the PAssion CARES QR at these events!

1By activating the PAssion POSB Debit Card, you agree on becoming a PAssion Card member and so consent to the bank’s sharing of relevant information with People’s Association (PA), as required for the sole purpose of creating your PAssion Card membership. Membership will be processed within five working days from date of card activation.

2For Singaporeans and Singapore PRs only. Click here for terms and conditions.

3Download the CapitaStar App and activate your CapitaStar privileges. Offer limited to first 10,000 members monthly. Visit www.capitastar.com for more information. Other terms and conditions apply.

4For more information on the PAssion CARES initiative, please log on to www.onepa.gov.sg/passion-card.

Click here for more information on PAssion membership.

More Info

The default daily limits set on your NETS Transactions, ATM Withdrawals and Debit Card Spend Transactions are set at S$5000, S$3000 and S$2000 respectively.

To find out what are the current daily spend/NETS/withdrawal limits on your debit card and to revise these limits, you may do so via Digibank online, under 'Cards > Change Debit Card Limit'.

The total amount of cash that you can withdraw per day at both local and overseas ATMs is capped. This daily cash withdrawal limit applies regardless of the number of cards you have. Click here for details.

Setting debit card limit to S$0 via digibank Online or Mobile

- If you prefer to only use your Visa, MasterCard or UnionPay Debit card(s) for PIN-based NETS and ATM transactions and would like to disable the contactless feature.

- Changing the limit for your Debit Card Spend Transactions will not affect your PIN-based NETS and ATM transactions.

Customise card functions with DBS Payment Controls

- Disable specific transaction functions and manage your monthly spend limit. Click here for more information.

Enjoy all the convenience in one card.

- Sign for point-of-sale and online transactions at Mastercard® accepting merchants worldwide

- Tap and go with Mastercard® contactless for purchases below S$200

- Pay for purchases at all NETS accepting merchants locally

- Withdraw cash overseas conveniently from ATMs with Mastercard or Cirrus logos

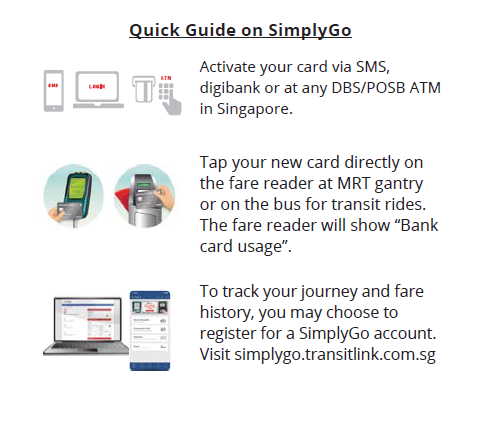

Tap and SimplyGo on buses and trains without having to top up

You can also access your travel history anytime and anywhere via the SimplyGo Portal or mobile app.

Click here for more information.

|  |

| What is SimplyGo and why should I use it? | Tap and SimplyGo! with POSB Mastercard |

You may enable the magnetic stripe on your card(s) via digibank or any DBS/POSB ATM in Singapore

Visit https://www.posb.com.sg/personal/support/card-overseas-enabling-for-overseas-use.html for more details.

Frequently Asked Questions

This PAssion POSB Debit Card can be used at ATMs and for PIN-based transactions at selected merchants in Singapore and at Maestro or Cirrus enabled merchants overseas. It also allows you to sign for local and overseas purchases and perform contactless payment via Mastercard® contactless, card-not-present transactions (such as online, mail and phone orders), which shall be paid for by directly deducting the transaction amount(s) from your bank account.

Your Mastercard Debit Limit for signature-based, Mastercard contactless and card-not-present transactions is set at S$2,000. A Debit Card carries risks of unauthorised signature-based, Mastercard contactless or card-not-present transactions. You may choose to increase/decrease this limit upon activation.

The yuu App is an app managed by yuu Rewards Club, the appointed loyalty programme partner for People Association. It is a one-stop app for PAssion Cardmembers to manage and redeem their rewards anytime, anywhere.

Yuu Rewards Club is operated by Minden Singapore Pte Ltd, a tech venture founded by Temasek in strategic partnership with DFI Retail Group.

To earn, track and redeem points, PAssion Cardmembers will have to first download the yuu App from Apple App Store, Google Play Store or Huawei AppGallery.

You will just simply need to link one card on the yuu App. All PAssion Cards tagged to your PAssion membership will then be automatically linked to your yuu Account.

There’s no need to – in fact, you can simply link your Card to the yuu App with your existing PAssion Card, spend, and enjoy the new offers!

The default daily limits set on your NETS Transactions, ATM Withdrawals and Debit Card Spend Transactions are set at S$5000, S$3000 and S$2000 respectively.

To find out what are the current daily spend/NETS/withdrawal limits on your debit card and to revise these limits, you may do so via iBanking, under 'Cards > Change Debit Card Limit'.

Effective 22 June 2020, all new, replacement and renewal cards issued will no longer have the CEPAS function for EZ-Link transactions. Commuters can now tap and SimplyGo on buses and trains without having to top up with their PAssion POSB Debit Cards.

Please notify us immediately by calling 1800 111 1111 (from Singapore) or +65 6327 2265 (International).

- Please make a police report and provide us with a copy of the report and in certain circumstances accompanied by written confirmation of the loss/ theft/ disclosure and any other information that we may require.

- Once we establish, with your assistance, that the loss or theft of your Card or PIN compromise was not due to your fault or negligence, your liability for unauthorised transactions effected after such loss, theft or unauthorised disclosure but before we are notified thereof shall be limited to S$100.

- You will not be liable for any transactions carried out after you have notified us.

- We will refund the amounts deducted from your bank account for unauthorised transactions, in excess of the applicable liability cap, within 14 working days from the time you submit all the necessary information to us.

- For EZ-Link refund enquries, please click here.