Frequently Asked Questions

Nope! SAYS and SAYE are like two cool cousins.

SAYS is the bank’s proposition to help NSFs save as they serve and reach their financial goals effortlessly. You can think of SAYS as a range of solutions tailored for NSFs, including a high-interest savings account, debit cards, PayLah! and Financial Planning.

On the other hand, SAYE is a savings account where you can stash away your savings every month and be rewarded with a cash gift interest for the first 2 years. Learn more about SAYE here.

No need to change a thing (unless you want to)! As long as you credit your NS allowance to any DBS/POSB account and use PayLah! for any retail spend, you will be able to earn the bonus interest on your savings in the Multiplier Account.

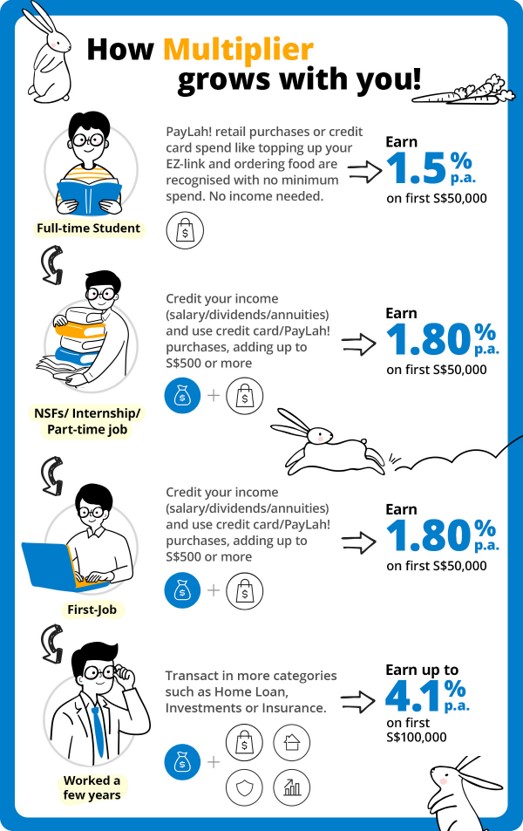

Nope, you don't have to! Your Multiplier Account is your financial sidekick, ready to help you level up your finances whether you're an NSF, Student or Working Adult! Here's an illustration on how to fulfill requirements to unlock bonus interest on your savings: