Help Topic

Bank

-

Account EnquiriesThere are various channels which you may open and check your account with us. The most convenient method would be via digibank online or digibank mobile.

Account EnquiriesThere are various channels which you may open and check your account with us. The most convenient method would be via digibank online or digibank mobile.- Open an Account with DBS/POSB

- Documents Required for Account Opening

- Enhanced Due Diligence Form

- Understanding your Bank Account and Services

- Activate Account (New to Bank Customers)

- Change MySavings/SAYE Account Instruction

- Check Account Transaction

- DBS/POSB Transaction Codes & Descriptions

- Resolve Unexpected Card Transactions

- Find your Account Number

- Peek Balance

- Check Account Balance

- Differences in Total and Available Balance

- Deposit Account Minimum Balance Service Charge

- Calculate Minimum Average Daily Balance (MADB)

- Retrieve and Share your Transaction Details

- View Joint Account Information

- Convert POSB Passbook Savings Account

- Request for DBS Account Conversion

- Close a DBS/POSB Deposit Account

-

Applications & FacilitiesRefer to our articles below for help on the various self-service banking channels made available for you.

Applications & FacilitiesRefer to our articles below for help on the various self-service banking channels made available for you.- Local Cash Withdrawal

- Deposit Cash

- Deposit Coins

- Notes Exchange

- Exchange Foreign Currencies using DBS Multi-Currency Autosave Account

- Apply for PayNow

- Apply for PayNow for your Child (<16 years old)

- Check PayNow Profile

- Update PayNow Details

- Cancel PayNow Profile

- Cancel Child's PayNow (<16 years old)

- Authentication in Phone Banking

- Phone Banking Services

-

Card EnquiriesIf you are having issues or enquiries related to your card, articles below may help you solve them.

Card EnquiriesIf you are having issues or enquiries related to your card, articles below may help you solve them.- Apply for a Debit Card

- Activate New Card

- Enable/Disable Card For Overseas Use

- Check Debit Card Transaction Details

- Transact & Withdraw in Foreign Currency Overseas

- Replace ATM/Debit or Credit Card

- Lost or Stolen Card

- Unable to Withdraw and Transact

- PIN & PAY

- Reset Card PIN

- Update ATM/Debit Card Limits

- Manage Accounts Linked to your Card

- Overseas Card Transaction Fees

- Overseas Withdrawal Charges

- Cancel Card

-

ChequesHave a cheque related query? Information below may help you clear all your doubts.

ChequesHave a cheque related query? Information below may help you clear all your doubts.- Deposit/Issue a Cheque

- Cheque Clearing

- Enquire Cheque Status

- Returned/Bounced Cheque

- Purchase Cashier's Order

- Purchase a Demand Draft

- Issue an Online Cheque

- Add Cheque or Demand Draft Recipient

- Remove Cheque or Demand Draft Recipient

- Deposit Cheque Wrongly

- Cancel Cheque

- Multiple Names in Cheque

- Request for New Cheque Book

- Foreign Currency Cheque Deposit

-

Child Development Account (POSB)Children are our future and we have prepared the right articles to aid your queries.

Child Development Account (POSB)Children are our future and we have prepared the right articles to aid your queries.- Join the Baby Bonus Scheme

- Eligibility for Baby Bonus Scheme

- Open a POSB Smiley Child Development Account (CDA)

- Activate Reserved Account(s)

- Save in POSB Smiley Child Development Account (CDA)

- Features of POSB Baby Bonus NETS Card

- Replace POSB Baby Bonus NETS Card

- Check POSB Smiley Child Development Account (CDA) Transaction

- Change POSB Smiley Child Development Account (CDA) Trustee

-

DBS Multiplier AccountLearn how you can earn higher interest with DBS Multiplier Account!

DBS Multiplier AccountLearn how you can earn higher interest with DBS Multiplier Account! -

Fixed DepositInformation regarding opening, placing and changing maturity instructions for your fixed deposit available here.

Fixed DepositInformation regarding opening, placing and changing maturity instructions for your fixed deposit available here. -

Local Funds TransferFunds transfer can be a harrowing experience and performing it digitally can be difficult. Refer to our articles below for more help.

Local Funds TransferFunds transfer can be a harrowing experience and performing it digitally can be difficult. Refer to our articles below for more help.- Transfer Funds using PayNow

- Add PayNow Recipient

- Remove PayNow Recipient

- Transfer Funds to Other DBS/POSB Account

- Add DBS/POSB Fund Transfer Recipient

- Remove DBS/POSB Fund Transfer Recipient

- Transfer Funds to Other Bank's Account

- Add Other Bank's Recipient

- Remove Other Bank's Recipient

- Retrieve and Share your Transaction Details

- Your Guide to DBS PayLah!

- Set up Standing Instruction for Local Funds Transfer

- View Standing Instruction for Local Funds Transfer

- Terminate Standing Instruction for Local Funds Transfer

- Change Local Funds Transfer Limits

- Transfer Funds to Wrong Local Account

- Unsuccessful Fund Transfer to Another Bank Account

- Receive Funds from Others

-

Overseas Funds TransferFunds transfer can be a harrowing experience and performing it digitally can be difficult. Refer to our articles below for more help.

Overseas Funds TransferFunds transfer can be a harrowing experience and performing it digitally can be difficult. Refer to our articles below for more help.- Your Guide to Overseas Funds Transfer

- Transfer Funds to Overseas Account

- Add Overseas Funds Transfer Recipient

- Remove Overseas Funds Transfer Recipient

- DBS Remit

- Country Specific Information for DBS Remit

- Fees and Charges for Overseas Funds Transfer

- Timing and Limits for Overseas Funds Transfer

- Reasons for Delayed Overseas Funds Transfer

- Check Remit Status

- Amend or Cancel your Overseas Funds Transfer

- Change Overseas Funds Transfer Limits

- Retrieve and Share your Transaction Details

- Set up Recurring Funds Transfer to an Overseas Account

- View/Amend Recurring Funds Transfer to an Overseas Account

- Delete Recurring Funds Transfer to an Overseas Account

- Transfer to Overseas Visa Card

- Transfer via PromptPay (Thailand)

- Transfer via Paynow UPI (India)

-

PaymentsRefer to the articles below if you need any details regarding bill payments.

PaymentsRefer to the articles below if you need any details regarding bill payments.- Make Bill Payment

- Understanding the Different Bill Payment Modes

- Add Bill Payment Organisation

- Remove Bill Payment Organisation

- Retrieve and Share your Transaction Details

- Bill Payment in Advance

- Pay Other Bank Credit Cards

- Add Other Bank's Credit Cards Recipient

- Remove Other Bank's Credit Cards Recipient

- Your Guide to DBS PayLah!

- eNets (D2Pay) Application

- Amend eNets (D2Pay) Payment Limit

- Change Account Designated for eNets (D2Pay)

- eNets (D2Pay) Deactivation

- Set up a GIRO Arrangement

- View Active GIRO Arrangements

- Update GIRO Payment Limit

- Terminate GIRO Arrangement

- Apply for a Recurring Bill Payment Arrangement

- Update Recurring Bill Payments with Billing Organizations

- Top Up Mobile Prepaid Number

-

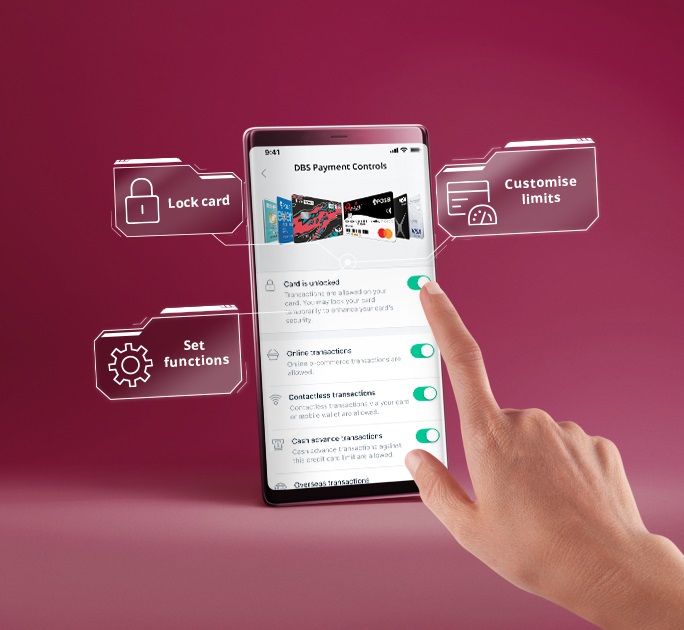

Payment ControlsControl and protect your cards with Payment Controls on digibank.

Payment ControlsControl and protect your cards with Payment Controls on digibank. -

POSB Payroll AccountAn easy step-by-step user guide for work permit holders.

POSB Payroll AccountAn easy step-by-step user guide for work permit holders. -

POSB digibankAny problems related to our digibank platform can be solved with the articles we have prepared for you.

POSB digibankAny problems related to our digibank platform can be solved with the articles we have prepared for you.- Minimum Operating System (OS) Requirements

- Your Guide to Digital Token

- Your Guide to digibank

- Set up your Digital Token

- Replace DBS Physical Token

- Apply for digibank

- Retrieve a Forgotten digibank User ID

- Change digibank User ID

- Reset digibank PIN

- Using your DBS Physical Token

- Manage Notification Alerts

- Manage Offers & Insights Notifications

- Switch your digibank mobile to Simple Mode

- Nav Planner

- SGFinDex

-

POSB Smart BuddyWanting your child to go cashless in school? Check out the POSB Smart Buddy!

POSB Smart BuddyWanting your child to go cashless in school? Check out the POSB Smart Buddy! -

StatementsStatements can be tough to understand but we have prepared some articles below for you.

StatementsStatements can be tough to understand but we have prepared some articles below for you.- DBS/POSB Transaction Codes & Descriptions

- Deposit Account Minimum Balance Service Charge

- Calculate Minimum Average Daily Balance (MADB)

- Differences in Ledger and Available Balance

- Consolidated Statements

- Retrieval of Printed Account Statements

- Apply for Financial Standing Statement

- Enrol to eStatement and eAdvices

- View your eStatements and eAdvices

- Manage your eStatement and eAdvices Notification

- De-enrol to eStatements and eAdvices