Help Topic

Credit Card

-

Application & TerminationAll information you require regarding card application and termination matters.

Application & TerminationAll information you require regarding card application and termination matters.- Apply for a Credit Card

- Apply for a Supplementary Card

- Documents Required for Card Application

- Credit Card Recommendation

- Eligibility for Credit Card Application

- Check Credit Card Application Status

- Cancel Card

- Cancellation of ANZ Credit Cards and Cashline Service Accounts

- Add Card to Mobile Wallet

- Pay with Mobile Wallet

- Remove Card from Mobile Wallet

-

Bill PaymentRefer to the articles below if you need any details regarding bill payments.

Bill PaymentRefer to the articles below if you need any details regarding bill payments.- Check Credit Card Outstanding Balance

- Pay Credit Card Bills

- Credit Card Payment Due Date

- Change Credit Card Billing Cycle

- Credit Card Payment Cut-off Times

- Set up GIRO Payment for DBS/POSB Credit Card Bill

- Terminate GIRO Arrangement

- Pay Other Bank Credit Cards

- Add Other Bank's Credit Cards Recipient

- Remove Other Bank's Credit Cards Recipient

- DBS Instalment Payment Plan (IPP)

- Apply for My Preferred Payment Plan

- Apply for a Recurring Bill Payment Arrangement

- Update Recurring Bill Payments with Billing Organizations

-

Card MattersIssues with your card? Refer to the articles here for steps to take if you need to activate or report a stolen card.

Card MattersIssues with your card? Refer to the articles here for steps to take if you need to activate or report a stolen card. -

Credit LimitIncrease credit limit permanently or temporarily can easily be done. Read our help articles on how this can be achieved.

Credit LimitIncrease credit limit permanently or temporarily can easily be done. Read our help articles on how this can be achieved. -

Fees & ChargesRefer to our articles below for more information on all the different types of applicable fees and how to submit a request for waiver.

Fees & ChargesRefer to our articles below for more information on all the different types of applicable fees and how to submit a request for waiver. -

Loyalty & RewardsNeed help in converting POSB Daily$? We can help you with these articles.

Loyalty & RewardsNeed help in converting POSB Daily$? We can help you with these articles. -

Overseas UseIf you are overseas or going overseas. The articles we have prepared below will be useful.

Overseas UseIf you are overseas or going overseas. The articles we have prepared below will be useful. -

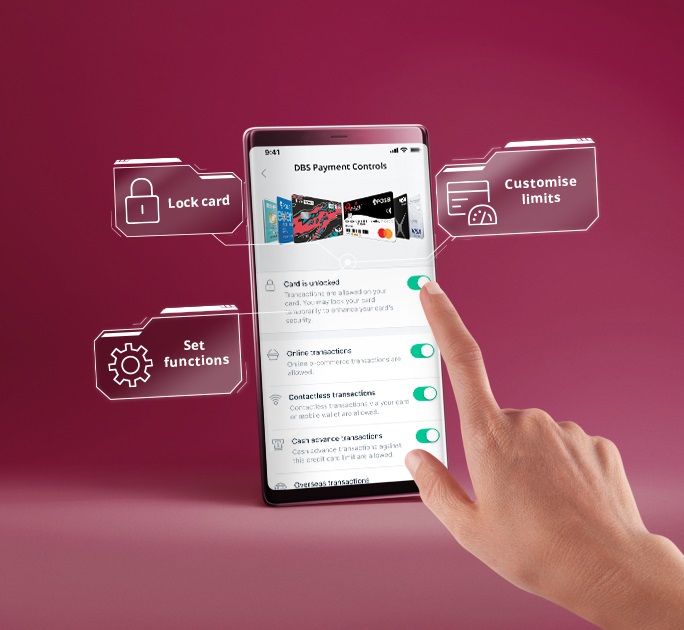

Payment ControlsControl and protect your cards with Payment Controls on digibank.

Payment ControlsControl and protect your cards with Payment Controls on digibank. -

TransactionReference on transactions you made with your card.

TransactionReference on transactions you made with your card. -

StatementCard statements can be tough to understand but we have help prepared for you the articles below.

StatementCard statements can be tough to understand but we have help prepared for you the articles below. -

Account SuspensionExceeding your borrowing limit, or having outstanding balances more than 60 days past due may lead to a suspension of account.

Account SuspensionExceeding your borrowing limit, or having outstanding balances more than 60 days past due may lead to a suspension of account.